End of Legislative Session: Key Taxpayer Victories

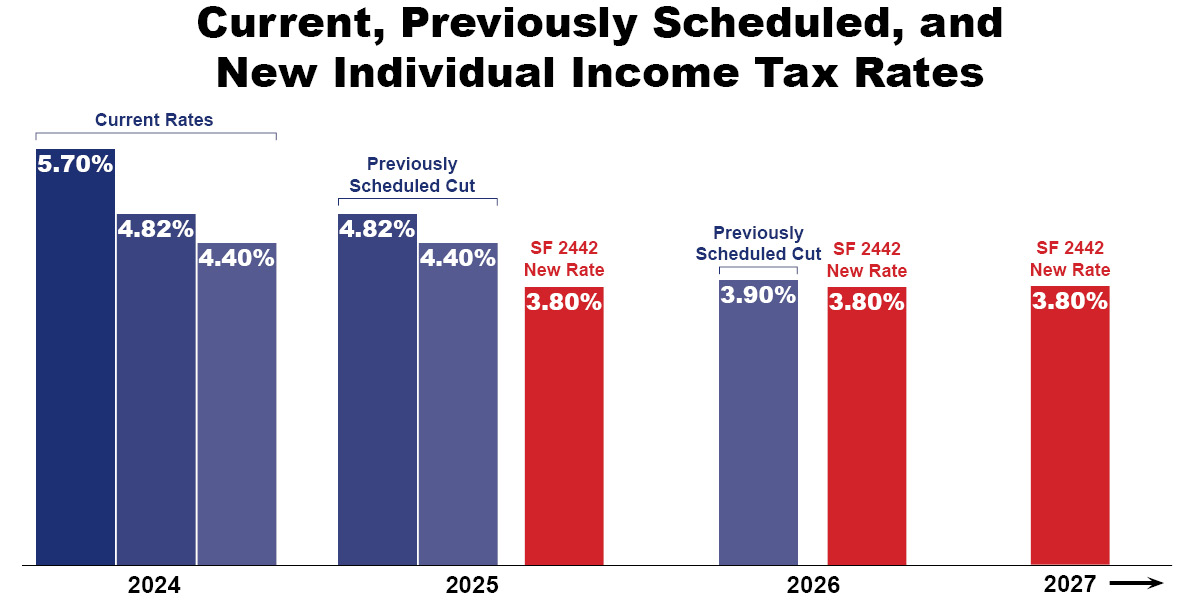

Watch or listen to the ITR Podcast! Iowa’s making bold moves, slashing income tax rates to 3.8%, catapulting us to the 6th lowest in the nation! Are Iowa taxpayers in a better position now than they were at the start of the legislative session? Yes, they are. In January, we said Iowa had set the tax reform gold standard other states wanted to follow and warned that we must not become complacent. While Iowa has…

Government wants your money any way it can get it!

How much does the government, at any level, take from Iowans with income tax, property tax, sales tax, fuel tax, and fees? Iowa lawmakers have worked hard to make state government better and more efficient…

Residential Property Tax Calculator

Did you get one of these property tax budget statements in the mail? The proposed property tax levy and public hearing notice you received in the mail is confusing and doesn’t show how much your…

Navigating Changes in Education

If the services provided by Iowa’s AEAs are critical, the need for transparency and accountability is even more important, not less. Leaving an entire system on autopilot does a disservice to students, school districts, and…

How has your local gov’t spending impacted YOUR property tax bill?

Find out at ITR Local.

Iowans Favor Eliminating State Income Tax

Iowans want their taxes cut and support legislative efforts to reduce their property and income tax burden. It’s plain as day. By a 2-1 margin,…

Is a supermajority requirement to raise taxes a threat to democracy?

No, it isn’t. It should be difficult to increase taxes. A higher threshold would simply force legislators to justify the need and build a coalition…

Universal Basic Income is Socialist Welfare

It should be simple and non-controversial to stop socialism in Iowa. However, this bill has met some resistance and apparently does not have the support…

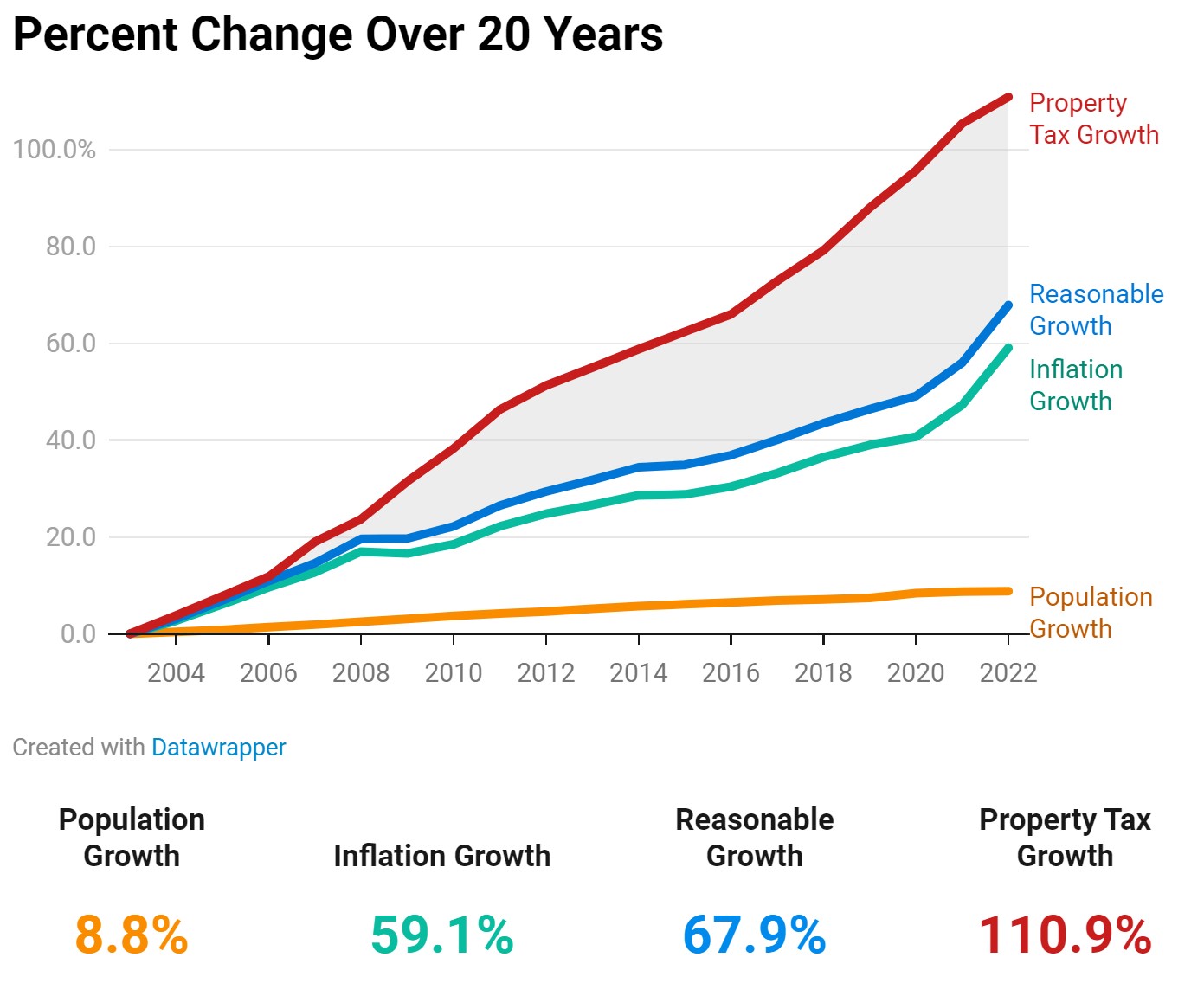

The True Cost of Property Taxes

Many city, county, and school governments seem to disregard Iowans’ struggle to achieve when their only focus is more taxpayer money to spend on their…

What Does ITR Do?

The government takes too much of your money and time. That’s why Iowans for Tax Relief (ITR) works to:

- Educate Iowans about our solutions

- Activate Iowans in support of our solutions

- Influence elected officials to enact our solutions

So the government will get out of your pocket and off your back!

Recent Victories:

- Increased property tax transparency and spending restraint

- Created a 3.9% flat individual income tax rate

- Eliminated state income taxes on retirement income

- Eliminated Iowa’s inheritance tax

- Set a path to reduce the corporate income tax from 9.8% to 5.5%

- Phased-out special tax incentives in the corporate tax code

“ITR has been fighting for Iowa taxpayers for over 40 years. I can’t tell you how important that is.

When ITR is at the Capitol, they are not working for just one business or industry. They represent ALL Iowa taxpayers.”

– Governor Kim Reynolds

Join ITR – It’s Free!

Stay updated on how elected officials spend your money. As the voice of the taxpayer, we will let you know when you should speak up.

Your Property Tax Bill:

The chart below shows the total property taxes collected by local governments across Iowa have grown much faster than the state’s population and inflation.

Learn more at ITRLocal.org