Poll: Iowans Want Constitutional Protection From Tax Increases

The most recent ITR Foundation Poll indicates a significant number of Democrats and Independents agree with Republicans that it should be a lot harder to raise taxes.

As much as the left resists efforts to cut taxes, they overwhelmingly don’t want to see them raised.

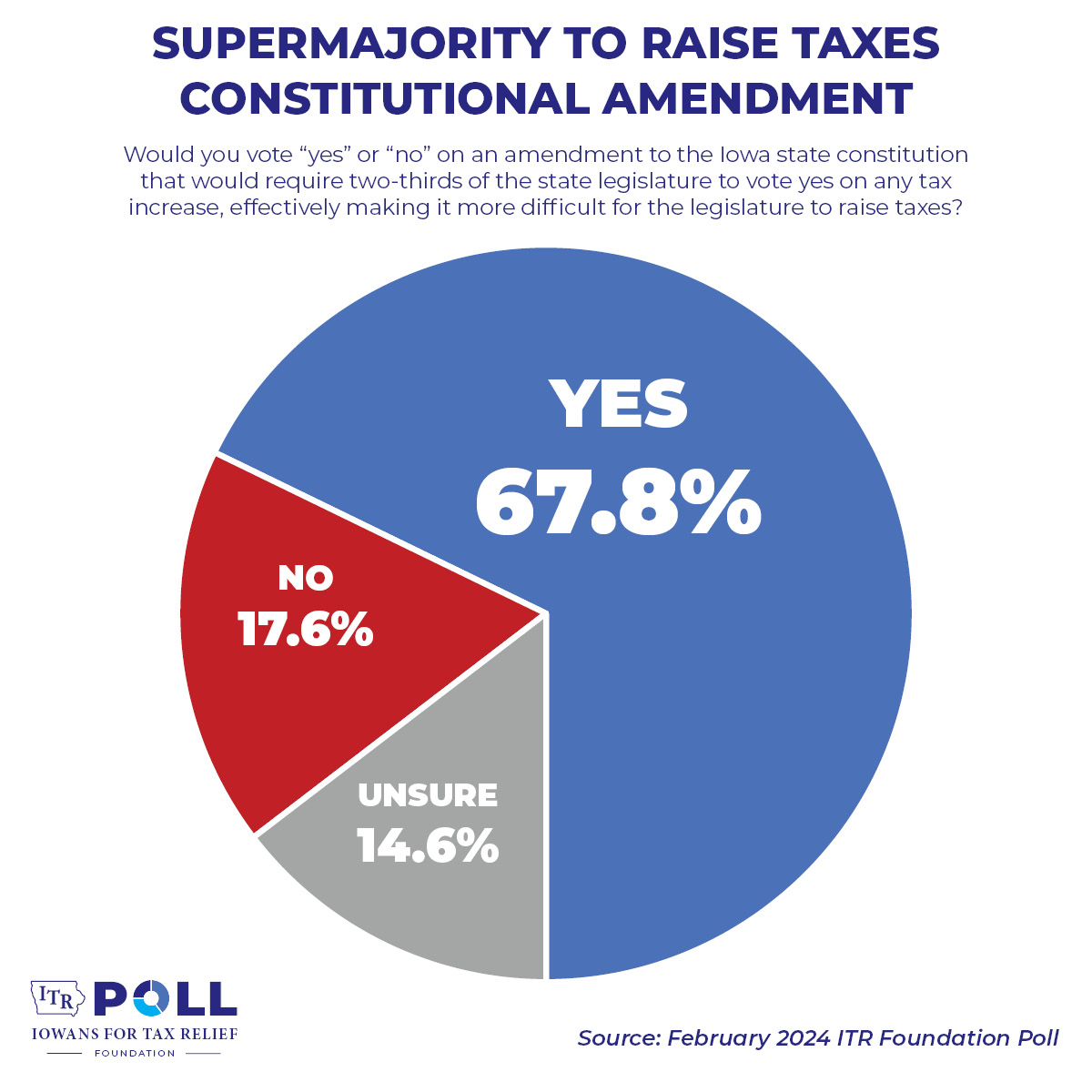

Supermajority to Raise Taxes Amendment

An amendment requiring two-thirds of the state legislature to vote yes on any tax increase is extremely popular across the political spectrum.

The poll shows 67.8% would vote for the amendment, 17.6% would not, and 14.6% undecided.

The overwhelming support crosses party lines, with a 53% majority of Democrats and over 70% of Republicans and Independents.

A two-thirds majority requirement would force legislators to justify why they want to raise taxes and make implementing new taxes, such as a wealth tax, more challenging.

Currently, 16 states have some form of supermajority requirement for tax increases, and seven states have it enshrined in their constitutions.

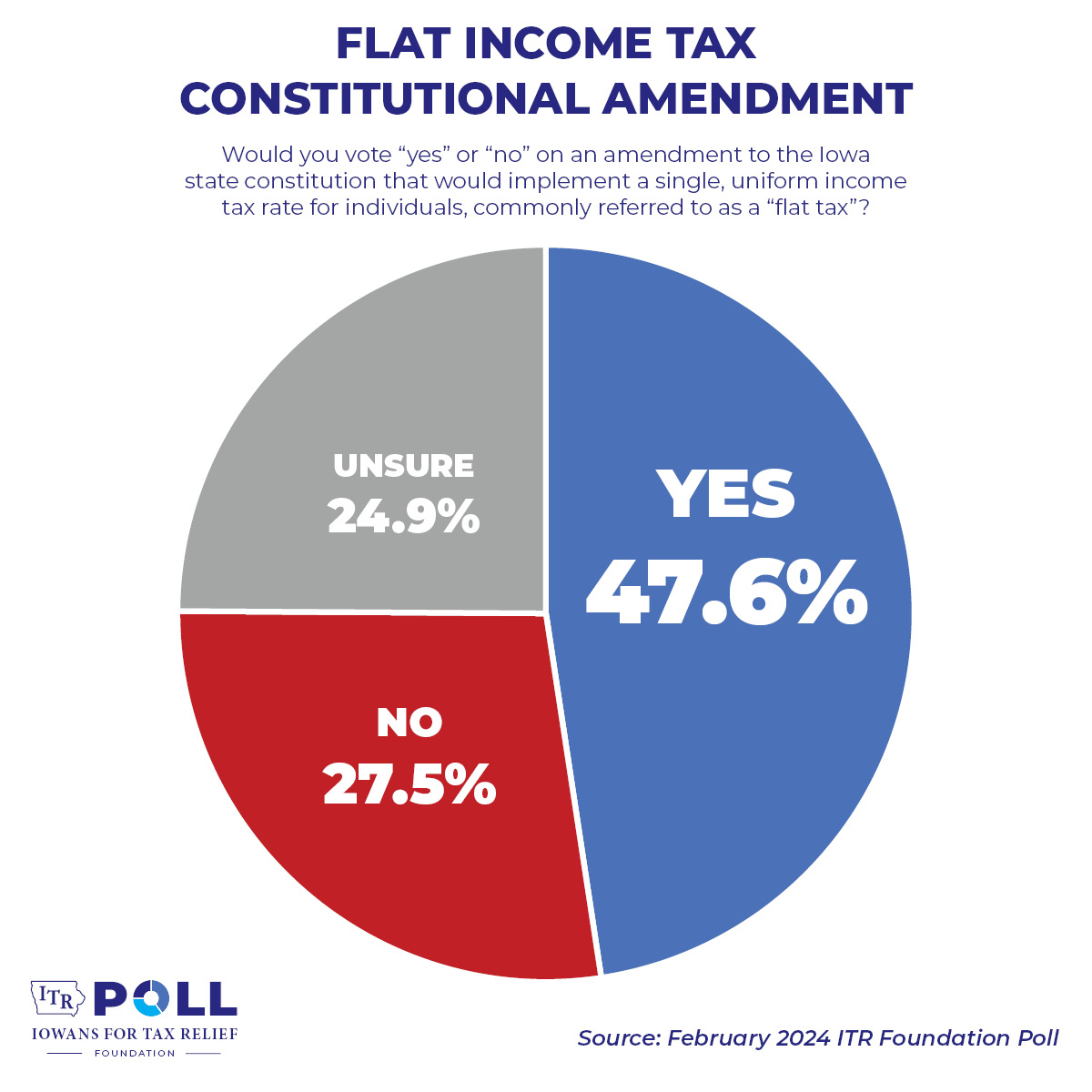

Flat Income Tax Amendment

Asked if they would support a “single, uniform income tax rate for individuals, commonly referred to as a “flat tax” amendment, the poll showed:

- A 47.6% plurality of Iowans support

- Republicans (55% yes – 19% no) support

- Independents (49% yes – 20% no) support

- Democrats (38% yes – 44% no) oppose

- Voters 55 and older are more likely to support the flat tax amendment than younger voters

Iowa is currently on the path to one flat tax rate. But it is just a law and a future legislature could entirely scrap the flat tax and go back to an aggressive scheme of higher progressive tax rates.

On today’s ITR Live podcast, Chris Hagenow, ITR President, said, “One thing is abundantly clear — Iowans want these kinds of constitutional protections for their tax burden. The legislature should pass the resolution this year and continue the process to let Iowans vote on these amendments.”

Iowa’s Constitutional Amendment Process

The supermajority and flat tax amendments are included in Senate Study Bill 3142. This bill has been introduced, referred to Senate Ways and Means, and was assigned a subcommittee on February 1.

The most rapid timeline for these amendments is:

- The legislation is passed by the House and the Senate this year (90th General Assembly).

- Legislative elections occur in November 2024.

- The House and Senate must pass the same legislation in 2025 or 2026 (91st General Assembly).

- All Iowans would then vote on it in November 2026 and need a 50% majority approval. The governor’s signature is not required.

More From the ITR Foundation Poll

In addition to the constitutional amendment questions, the poll found:

- More than two-thirds (68.2%) of those surveyed believe the United States is heading in the wrong direction, including an overwhelming majority of Republicans (92%) and Independents (72%).

- President Joe Biden was similarly unpopular, with a substantial majority of Iowans (64.7%) holding an unfavorable opinion of the president.

- Looking ahead to the 2024 presidential election, a potential rematch of the 2020 race showed Donald Trump (49.2%) was preferred over Joe Biden (40.0%).

- The generic Republican candidate (49.9%) holds a lead over the generic Democratic candidate (37.6%) in this year’s Congressional contests.

- Congressional voters now identify illegal immigration and the border as their top issue.

- More than three-quarters of those surveyed (76.0%) support placing additional limitations on foreign ownership of land in Iowa.