Government wants your money any way it can get it!

How much does the government, at any level, take from Iowans with income tax, property tax, sales tax, fuel tax, and fees?

Iowa lawmakers have worked hard to make state government better and more efficient in the past few years. They’ve managed to reduce or get rid of some taxes. The inheritance tax and retirement income tax have been eliminated. The income tax has been reduced and will be at a flat 3.9 percent in 2026.

But, what people in Iowa are really worried about is how much tax they have to pay in total. How much does it cost just to live in Iowa?

Many Iowans are struggling to get by. They have to make difficult choices about how to use the money they have left after the government takes a large part of their income.

Not every person who pays taxes is in the same situation. Some people might not make a lot of money, but they own a lot of property, or it could be the other way around. People of all ages are affected. Whether it’s young families, people in the middle of their lives, or those who have retired, everyone is finding it tough to deal with Biden’s inflation and the current economic environment.

Iowans want to save more of their money and pay fewer taxes.

That’s why we need to constitutionally protect Iowa’s recent tax reform victories.

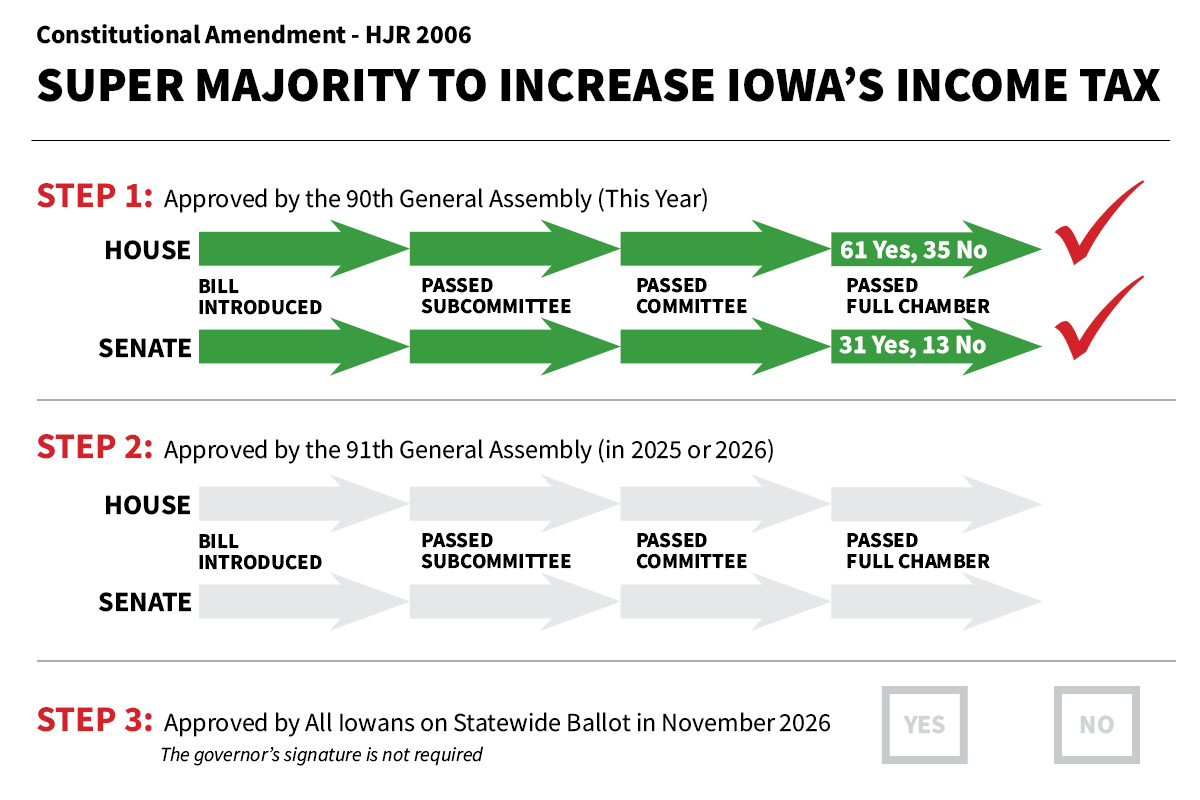

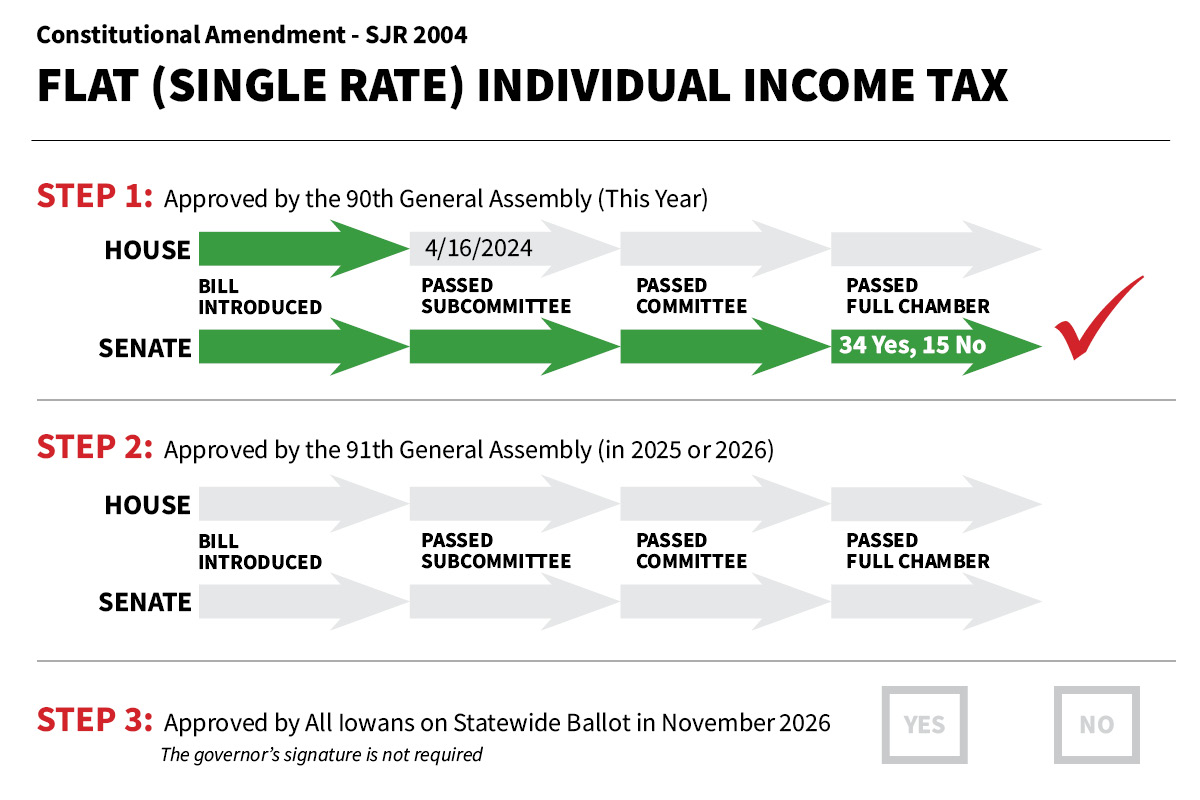

Two amendments are moving through the legislature this year. The first would require a supermajority (two-thirds majority) vote of both chambers of the legislature to approve an income tax increase. A second would prohibit the state income tax from returning to a progressive multiple rate tax after reaching a single rate or flat tax in 2026.

These are popular ideas. A recent ITR Foundation Poll found 68 percent of Iowans support the two-thirds amendment and making it harder to increase the income tax. The flat tax amendment received a plurality (47.6 percent) of support. ITR believes the 25 percent indicating they were unsure indicates this amendment is harder to explain, in large part because Iowa has never had a flat tax.

The Iowa House passed the super majority amendment 61-35 on March 26. The Senate passed it 31-13 on April 10.

The Senate passed the flat tax amendment 34-15 on April 2. The House has a subcommittee meeting scheduled for next Tuesday, April 16.

The House and Senate must pass the same legislation in 2025 or 2026 (91st General Assembly). Then, all Iowans would then vote on it in November 2026 and need a 50% majority approval. The governor’s signature is not required.

These amendments would protect Iowans for generations. If a future legislature wants to increase income taxes, it would need to achieve either widespread agreement or secure a supermajority support in both legislative houses.