Create a Local Government Spending Limitation

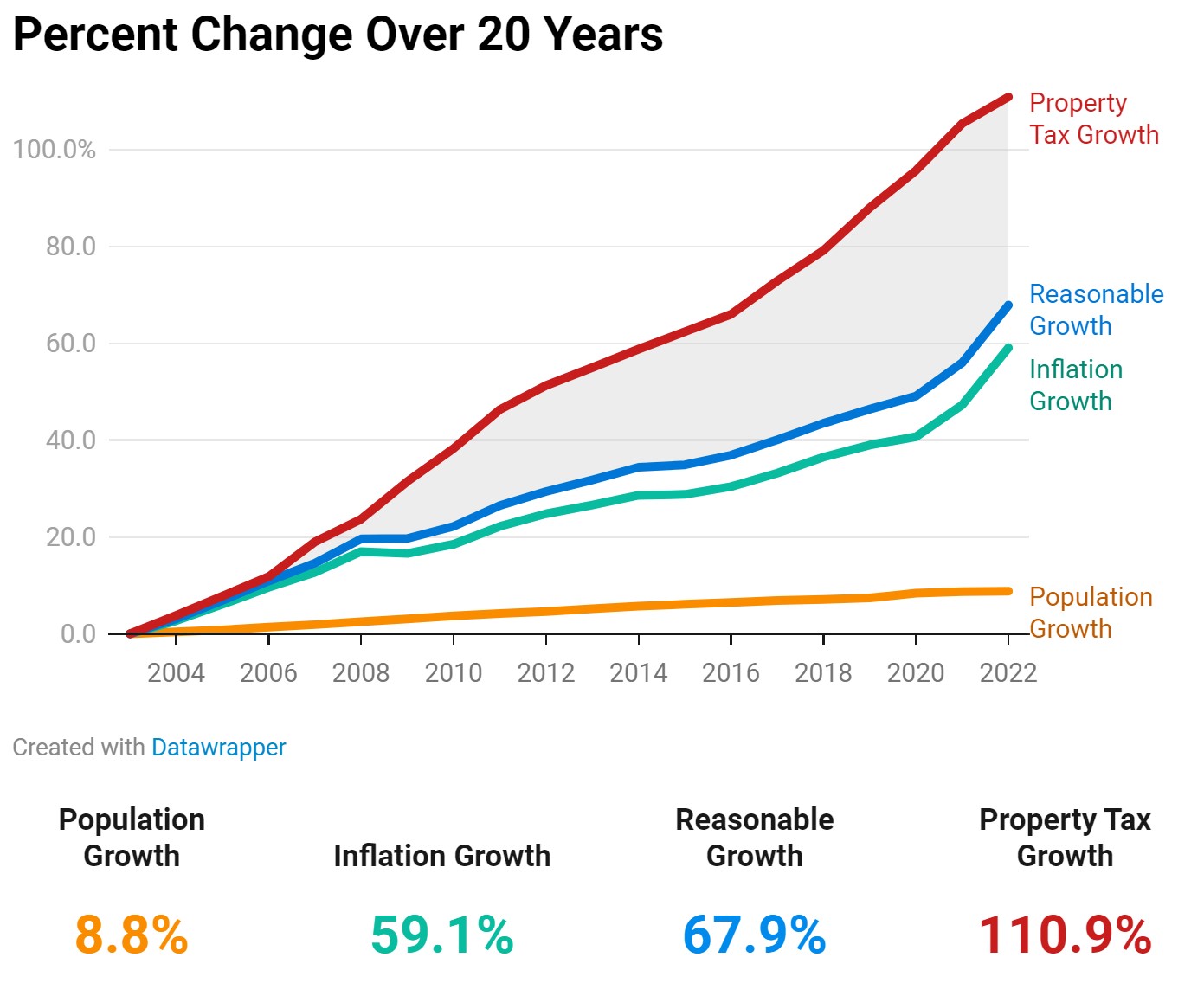

Since 2004, total property taxes in Iowa have increased 110.9 percent. This is far more than the rate of inflation and the state’s population growth.

Iowa ranks in the bottom ten (41st) states in the Tax Foundation rankings for the highest property tax burden.

Last year’s property tax reform bill was a good first step and added transparency to a complex tax system. Cities and counties will no longer have a blank check to grow their spending as a result of growth in property valuations.

Last year’s property tax reform was a good first step, but don’t stop now!

Further reform is needed to address the main cause of high property taxes. The problem is not assessments, but government spending.

Therefore, any property tax reform must include a spending or budget limitation that is applied to the entire local government budget.

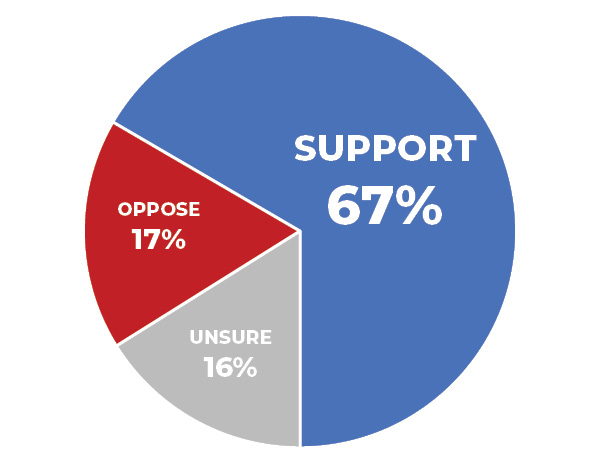

An ITR Foundation public opinion poll found that 67 percent of Iowans surveyed support the legislature establishing limits on how much a local government can tax and spend in order to control the growth of property taxes.

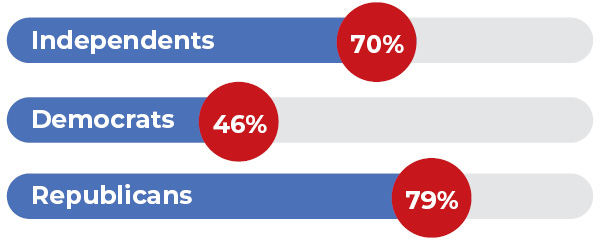

Limiting local government spending receives bipartisan support:

To control the growth of property taxes, do you support or oppose the state setting limits on how much a local government can tax and spend?

Source: April 2023 ITR Foundation Poll

Control property tax growth with local government spending limits.

Limits in New York have successfully saved taxpayers billions and haven’t hindered local governments or public education.

New York has a property tax revenue cap limiting the annual growth of taxes levied by local governments and school districts to the lesser of 2 percent or the rate of inflation. For a local government to exceed the cap, the governing authority must approve it by a supermajority vote.

“Spending limits are similar to speed limits in a school zone — both are designed to protect. In the case of local governments, they apply the brakes to slow spending down.” – Economist Daniel Mitchell

A spending limit allowing local government budgets to grow 1 or 2 percent and then require a vote of the people if more spending is needed.

A stronger spending limitation on all local governments, including school districts, would require voters to approve a budget increase and avoid interfering with the market’s ability to determine property valuations. It would also avoid the pitfall of exempting various budget categories.