Let’s Keep Going!

Iowa is in a strong position to enact even further income tax reform.

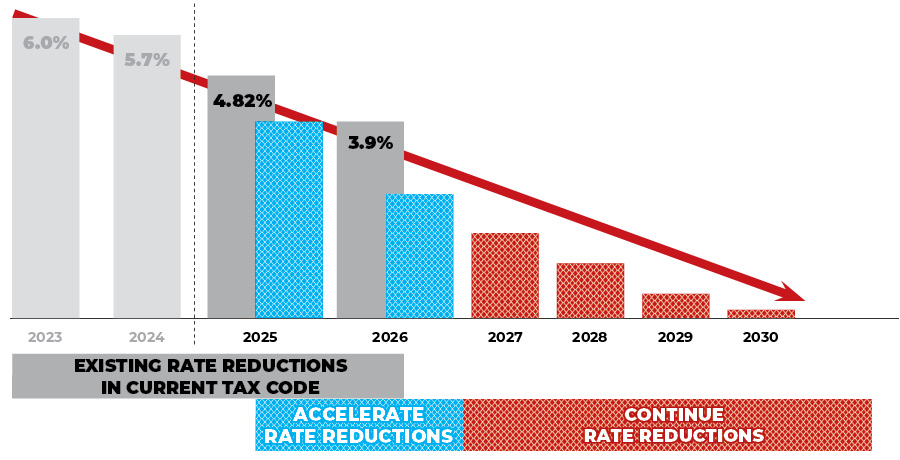

1. Accelerate existing rate reductions

Accelerating the existing tax rate reductions to get to the 3.9 percent flat rate before 2026 is possible as a result of built-in budget growth. This would create an opportunity for policymakers to establish a lower flat tax rate.

2. Continue to lower rates.

The short-term goal should be a 2.4 percent or lower flat tax, which would be the lowest flat tax in the nation. Arizona currently has a 2.5 percent flat tax. If needed, use the Taxpayer Relief Fund to supplement revenue.

3. Create a path to eliminate the income tax.

The overcollection of taxes from Iowans has increased the Taxpayer Relief Fund to an estimated 3.6 billion in 2024. Use this fund to supplement revenue to gradually reduce rates with the goal of eliminating the individual income tax.

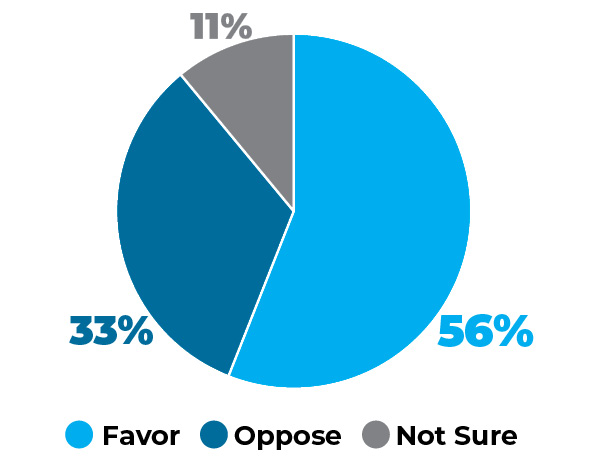

A Majority of Iowans Support Legislation to Reduce Income Taxes

“Do you favor or oppose gradually reducing the state’s individual income tax rate until it is eliminated?”

March 2023 Des Moines Register/Mediacom Iowa Poll