Residential Property Tax Calculator

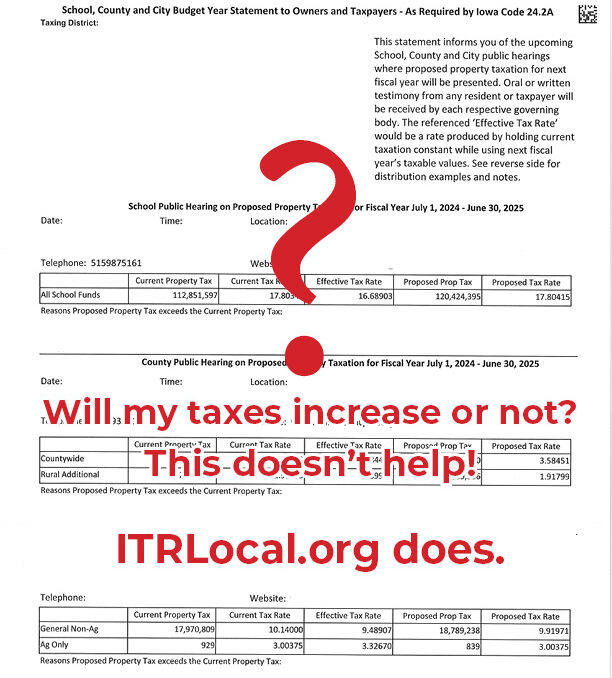

Did you get one of these property tax budget statements in the mail?

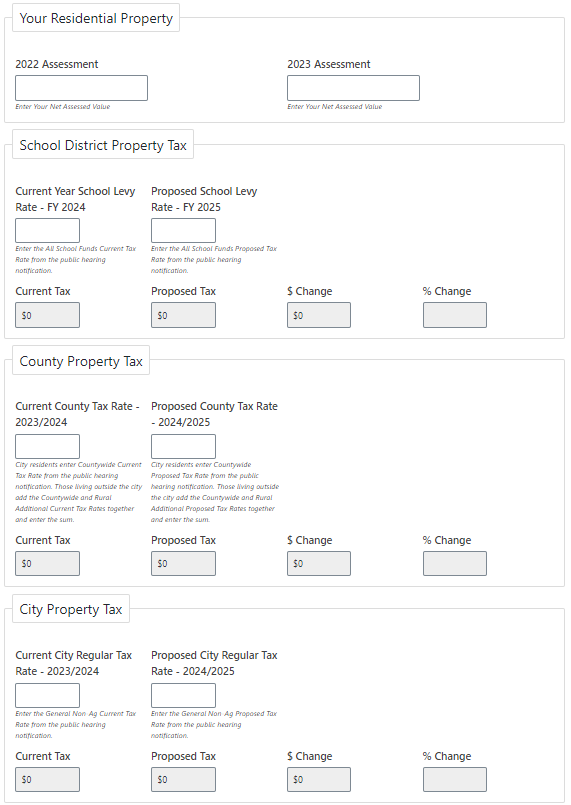

The proposed property tax levy and public hearing notice you received in the mail is confusing and doesn’t show how much your taxes will increase. That’s why we made a calculator to estimate your tax bill’s change.

The most important information on the notification is the date, time, and place of your public hearing.

These hearings give local elected officials a chance to explain why they need to increase your tax bill and take more of your hard-earned money. But more importantly, it’s your chance to tell them how a tax increase would affect your household budget. After all, your budget should be what matters most!

As Americans, it’s our duty to participate and ask questions of our government.

That’s why we’re urging all Iowans who care about their property tax burden to attend and speak at their city, county, and school budget hearings.

Examples of what others have said:

- “Will your proposed budget increase my property tax bill?”

- “Please don’t play the blame game. I know the assessor only places a value on my property, but YOU create the budget and determine the amount of my tax bill.”

- “I didn’t buy ________________ because my property tax bill went up.”

- “Inflation destroyed my budget. I had to decide what I could buy and what I couldn’t. The city/county/school needs to do the same.”

Your feedback can have real consequences and might help control your property tax bill. Even hearing from just a few people on an issue could signal a groundswell of opinion. So, it’s crucial for you and your neighbors to show up and share how property tax increases impact your lives.

Download our Property Tax Public Hearing Guide for a template of what to say when you attend your public budget hearing.

Amplify the voice of taxpayers by sharing this information with your neighbors. Working together, we can start to see some property tax relief!