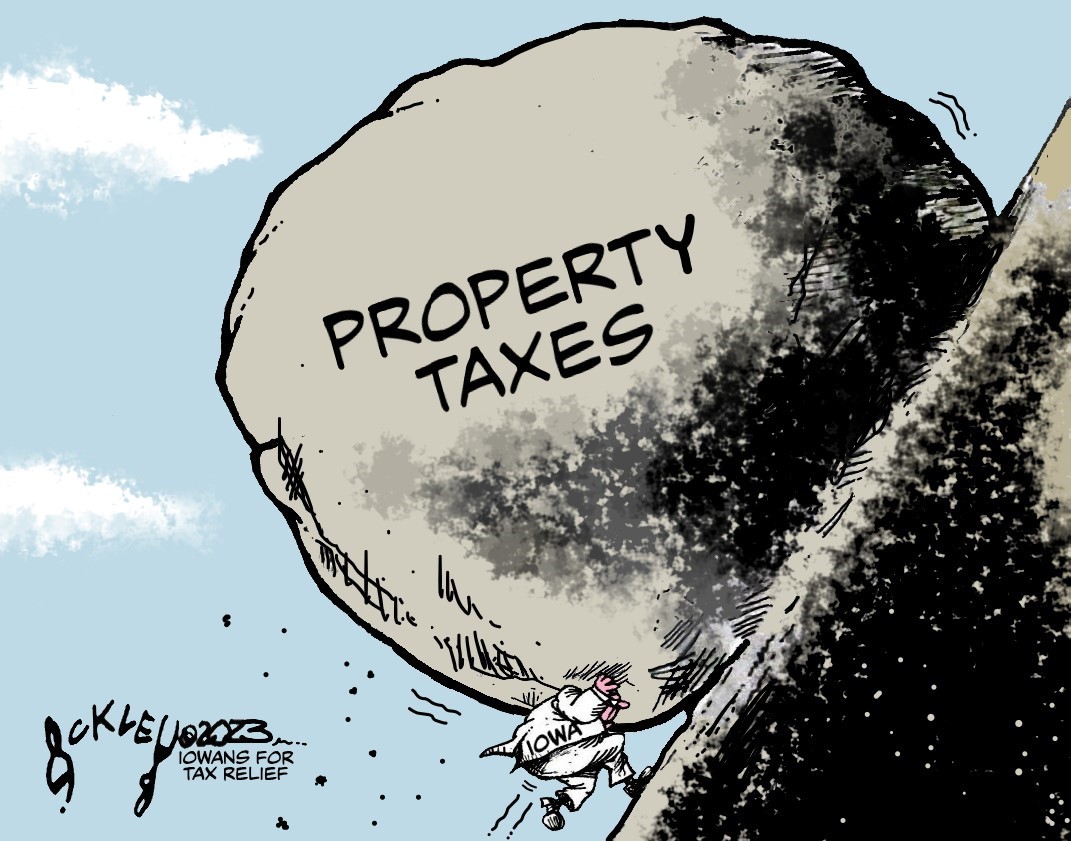

The True Cost of Property Taxes

Many city, county, and school governments seem to disregard Iowans’ struggle to achieve when their only focus is more taxpayer money to spend on their special projects.

According to a recent WalletHub article, Iowa has one of the highest property tax burdens in the country. The 1.49 percent of their home’s value Iowans pay in property taxes yearly ranks as the 10th highest in the country.

Real-Life Impact

ITR recently heard about a woman’s journey trying to improve her life. She escaped her abusive husband, and after living in her car, under bridges with her three children, she ended up in a homeless shelter. With the shelter’s support, she got back on her feet and went back to school. She now has a degree in counseling and works full-time at the homeless shelter. Her kids are all good students, and her sons are now volunteer firefighters in the community. One of the things she is most proud of now is that she is a homeowner.

She worked hard to own a house but now is coming to grips with the property tax burden that comes with it. Her city, school, and county governments seem to disregard her struggle to achieve when their only focus is more taxpayer money to spend on their special projects.

The government needs to quit taking so much.

Property taxes were an unnecessary hurdle for her. Rent increases because landlords have no choice but to pass on that expense. Businesses struggle to afford leases because of tight profit margins. For homeowners, do they even own their own homes?

Think about your grocery bill, your gas bill, everything else. Expenses increase, and affordability decreases.

Paying 1.49 percent of your home value yearly for property taxes is simply too much. It needs to come down. Reducing our collective tax burden is better for us economically, but these things impact every Iowan at a fundamental level and change how people live their lives.

Property tax bills are determined right now.

Next year’s local government’s proposed budgets will soon be finalized. Many county supervisors have been lashing out at legislators and policies as simple as the assessment rollback. They point the finger at everyone but themselves because they have a tight budget and lose sight of the fact that Iowans don’t want to pay this much.

Local officials cannot see Iowans are overtaxed on their property taxes. Their entire paradigm is based on their local budget and what it means for them.

We’ve heard from many state legislators who are sick and tired of being lectured by city and county officials. The legislature gets it and knows how upset Iowans are because they go door to door and hear it from voters. Remember, last year’s property tax relief bill passed with only one dissenting vote.

Upset city councilmen and county supervisors try to blame and lecture those dastardly legislators of both parties who simply stood up for their citizens when their local government wouldn’t do it anymore.

The vast majority of these local governments are just flat wrong when complaining about cuts. Revenue was not cut; the legislature just limited their growth. Simply put: Property tax revenue collected by cities and counties will continue to increase.

Only in government is slowing the growth of spending seen as a cut. Cal Thomas once said:

“It’s funny that government can never afford to cut taxes or spending, but taxpayers are never asked whether they can afford higher taxes.

When your city council, county board of supervisors, or school board chooses to increase spending and raise property taxes, they need to clearly explain why the government needs the money more than you do.

Take Action!

Visit ITR Local to see how your community’s property taxes have grown compared to inflation, population, and school enrollment. Use the information on ITR Local to learn more about your local government budgets, share it with your neighbors, and start a conversation with your elected officials.

Keep an eye on your mailbox. Property tax public hearing notices will be mailed in March. ITR will keep you updated and provide information for you to share when you attend.