Protect Iowa Taxpayers

These constitutional amendments are common-sense safeguards.

1. Two-Thirds Legislative Majority to Increase Taxes

A two-thirds majority requirement would force legislators to justify why they want to raise taxes and make it more difficult to implement new taxes such as a wealth tax. Currently, 16 states have some form of supermajority requirement for tax increases. Seven states have it enshrined in their constitutions.

2. Secure the Taxpayer Relief Fund

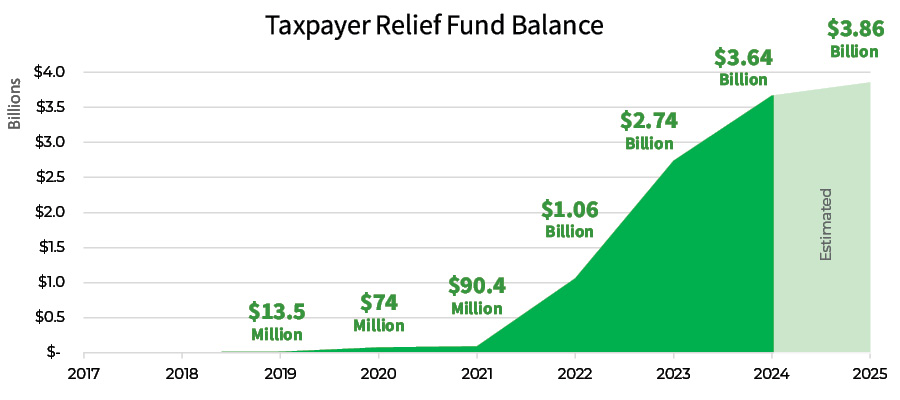

The Taxpayer Relief Fund is projected to have a balance of $3.6 billion in fiscal year 2024. In fiscal year 2025 it is projected to increase to $3.8 billion. It is increasing as a direct result of the overcollection of income and sales taxes.

This fund was originally created for the specific purpose of income tax relief. It now has such an enormous balance that legislators and special interests are tempted to spend the money rather than use it as intended.

Constitutional protections would guarantee the Taxpayer Relief Fund is only used for income tax relief to benefit taxpayers and not special interests.

“I was there when it was the Taxpayer Trust Fund. The whole idea was when the state brought in more money than it needed, those dollars would be taken off the table, out of the hand of the spenders, and create a mechanism to ultimately give it back to the taxpayer.” – ITR President Chris Hagenow