Conservative Budgeting and Reforming Government

Future tax reform has to be paired with spending restraint.

Pro-growth tax reform cannot occur without reasonable budgeting and controlled spending. In recent years, Iowa has excelled at both.

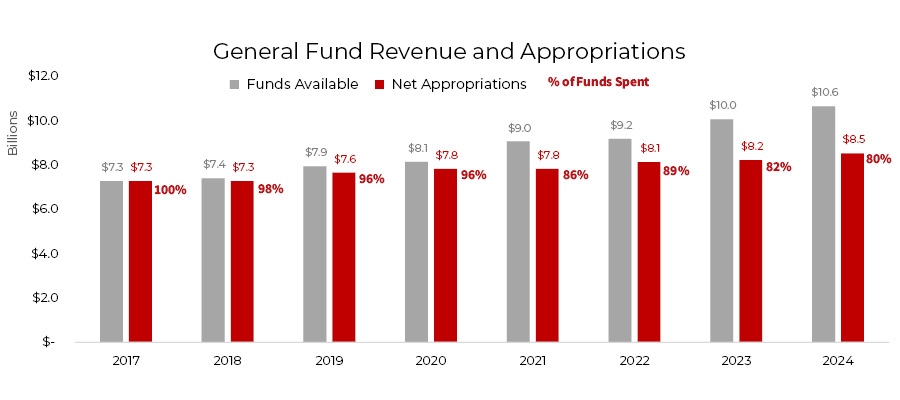

- The $8.2 billion budget in FY 2023 had an increase of just 1 percent over the prior year, spent only 82 percent of available revenue, and had a $1.8 billion surplus.

- For FY 2024, legislators passed an $8.5 billion budget. This was a 3.6 percent increase, spent only 80 percent of projected revenue, and has an estimated $2.1 billion surplus.

Iowa revenue continues to be strong even with the phased-in tax cuts and the national economic uncertainty. The Cash Reserve Fund and the Economic Emergency Fund continue to be funded at their statutory limits and have a combined balance of over $961 million. The Taxpayer Relief Fund also continues to grow. The balance in the fund for FY 2023 is $2.7 billion and is estimated to increase to $3.6 billion in FY 2024 and $3.8 billion in FY 2025.

“Like any large organization, government is marked by bureaucracy’s natural tendency to grow. If that growth isn’t constantly checked and rechanneled toward its core function, it quickly takes on a life of its own.”

– Governor Kim Reynolds

Iowa has proven that fiscal restraint works and the priorities of government can be fully met.

The legislature has the opportunity to build upon Governor Reynolds’s state government reorganization measure. Limiting Iowa’s bureaucracy or administrative state is just as important as limiting spending.