End of Legislative Session: Key Taxpayer Victories

Watch or listen to the ITR Podcast!

Iowa’s making bold moves, slashing income tax rates to 3.8%, catapulting us to the 6th lowest in the nation!

Are Iowa taxpayers in a better position now than they were at the start of the legislative session? Yes, they are.

In January, we said Iowa had set the tax reform gold standard other states wanted to follow and warned that we must not become complacent. While Iowa has significantly reduced income tax rates, there is still more work to be done. We must keep enhancing our state’s tax code and ensure these improvements are preserved for future generations.

The legislative session ended last week. The ITR Live podcast gives great insight and analysis, and below is a summary of the taxpayer victories ITR lobbied for at the Capitol.

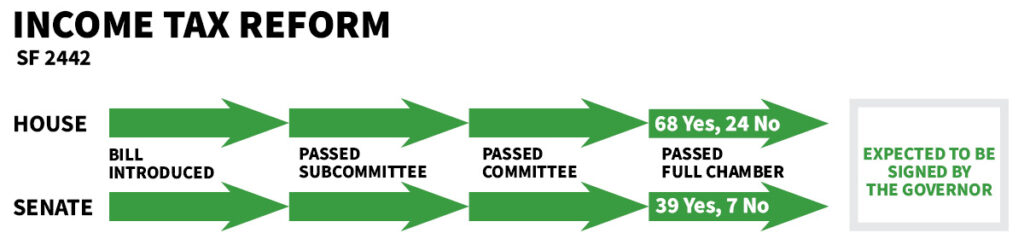

ITR laid out the bold objective of accelerating existing rate reductions, continue to lower rates, and create a path to eliminate the income tax. Legislators passed, and Governor Reynolds is expected to sign a bill to accomplish two of those goals.

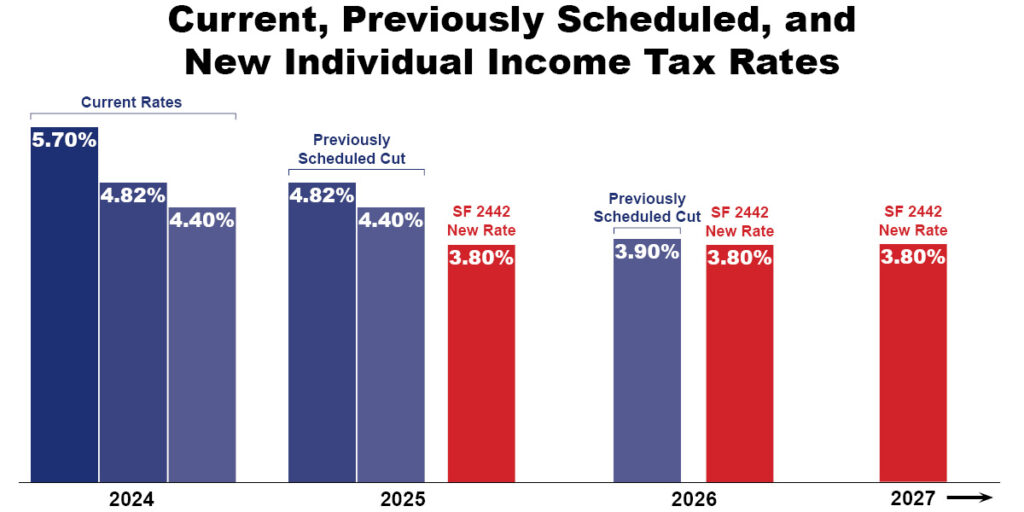

This year, the top individual rate is 5.7%. It was scheduled to drop to 4.82% in 2025 and then to a flat 3.9% in 2026. SF 2442 will speed up planned tax cuts and implement a flat 3.8% individual income tax starting in tax year 2025.

Iowa has been taking too much from taxpayers. Due to fiscal conservatism, Iowa ended FY 2023 with a $1.83 billion surplus, and our state’s reserve accounts are filled to their statutory maximums (over $900 million). Additionally, repeated surpluses have significantly increased the balance of the Taxpayer Relief Fund, which now stands at $3.6 billion and is expected to grow.

These cuts will not starve the beast. Legislators did not cut into planned future obligations; they only cut into the projected surpluses.

The tax reform, primarily championed by the Republican majority in both legislative chambers, also received notable bipartisan support. During the debate’s closing comments, two Democratic legislators acknowledged that the new, lower flat tax rate would particularly benefit lower and middle-income Iowans.

This is a win for taxpayers. Iowans are estimated to save over a billion dollars in taxes from 2025 to 2027.

Read ITR Foundation’s Tax Cut Analysis

Constitutional Amendments Protecting Taxpayers

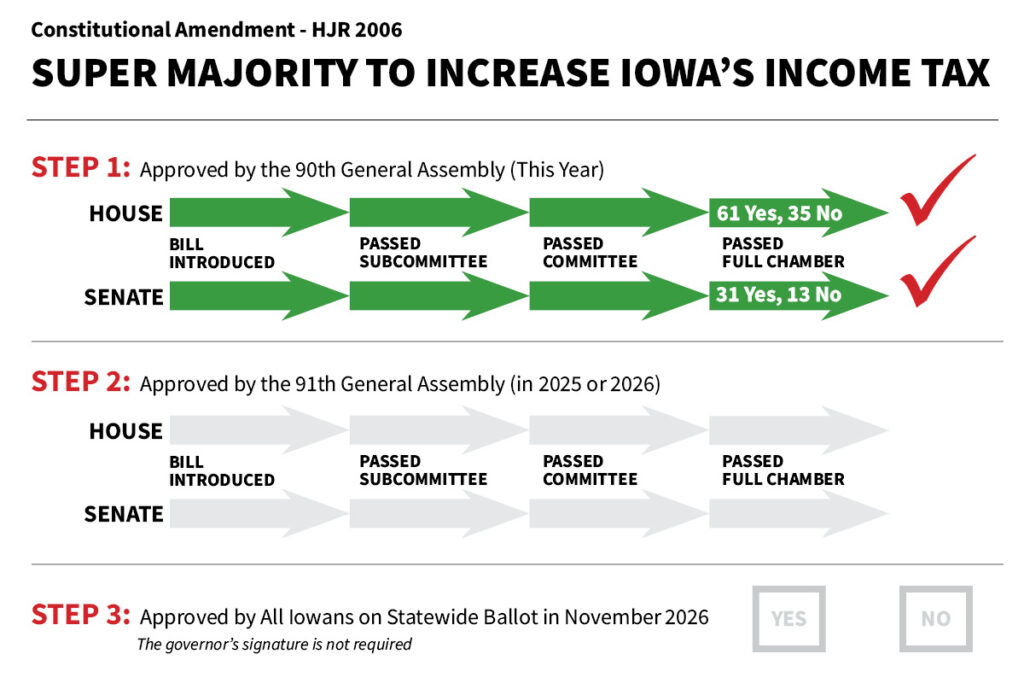

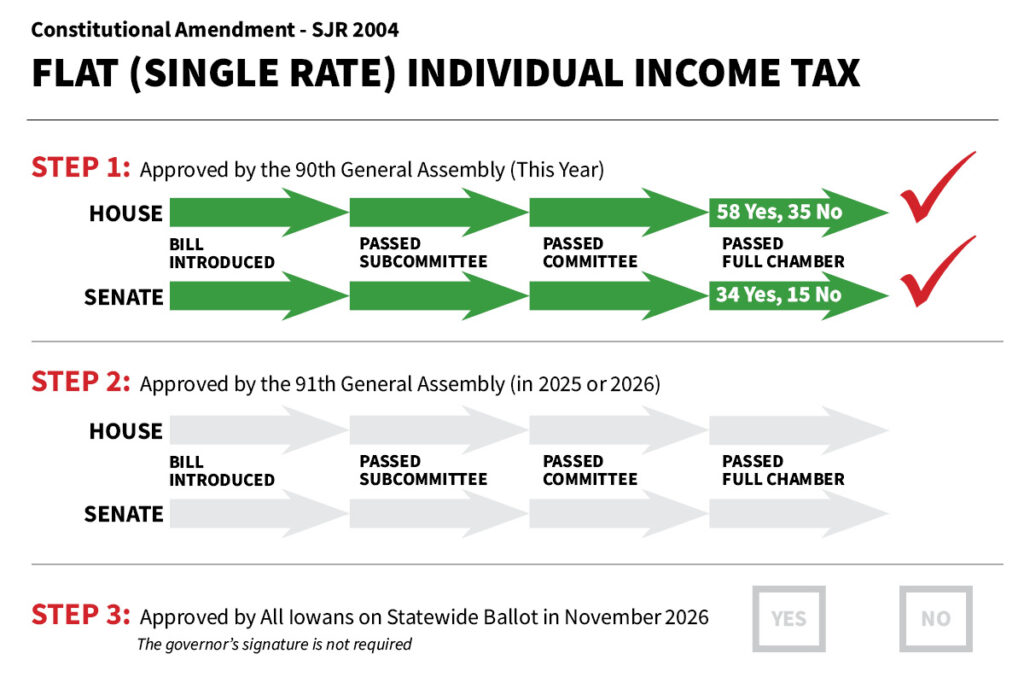

Two amendments to the Iowa constitution completed the first of three steps for approval this year. The first would require a supermajority (two-thirds majority) vote of both chambers of the legislature to approve an income tax increase. A second would prohibit the state income tax from returning to a progressive multiple-rate tax after reaching a single rate or flat tax in 2026.

The Iowa House passed the super majority amendment 61-35 on March 26. The Senate passed it 31-13 on April 10.

The Senate passed the flat tax amendment 34-15 on April 2, and the House passed it 58-35 on April 19.

Completing the first step for these constitutional amendments is a win for taxpayers.

Local governments in Iowa should not be allowed to unconditionally give some of their residents hundreds of dollars each month.

The cry for local control is terribly overused. Local control is only claimed when they want to tax you more or take away your freedoms. It is never asserted in a way that stands up for the individual.

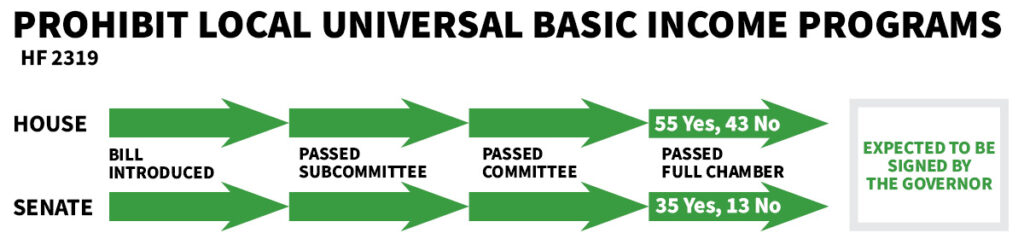

Legislators passed HF 2319 and Governor Reynolds is expected to sign the bill prohibiting local government from engaging in this type of socialism.

This is a win for Iowa taxpayers.

Read ITR Foundation’s Local UBI Ban Analysis

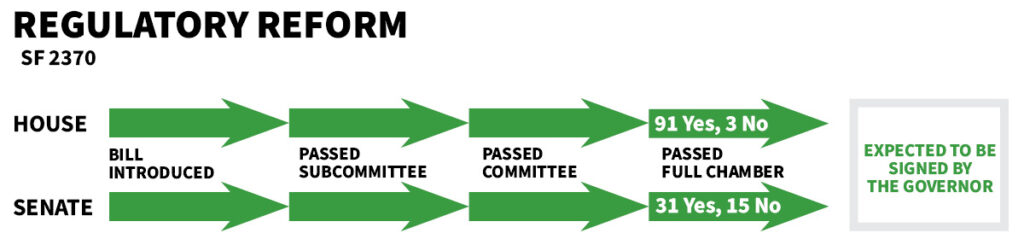

Regulations are more than just rules.They are a hidden tax and can be costly.

Governor Reynolds says SF 2370 “cuts red tape and improves Iowa’s regulatory environment, requires a regulatory analysis of all new rules, and sunsets rules unless they undergo a substantive review and are re-adopted at least every five years.”

This is a win for Iowans.

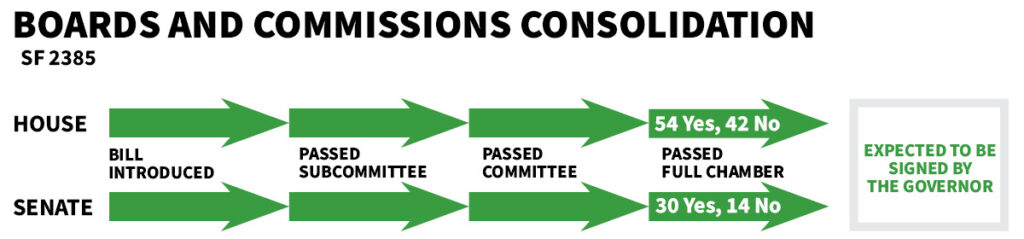

Governor Reynolds said, “Government works for the people, not the other way around. We should be consistently reviewing and improving the quality of services we provide.”

She introduced a bill, SF 2385, that would have consolidated or eliminated 111 of the state’s 256 Boards and Commissions. The Senate passed the Governor’s bill, the House narrowed the list, and the final bill only eliminated 74 and consolidated nine boards and commissions.

This is a win for Iowans.