13 Counties Clearly Chose To Increase Property Taxes

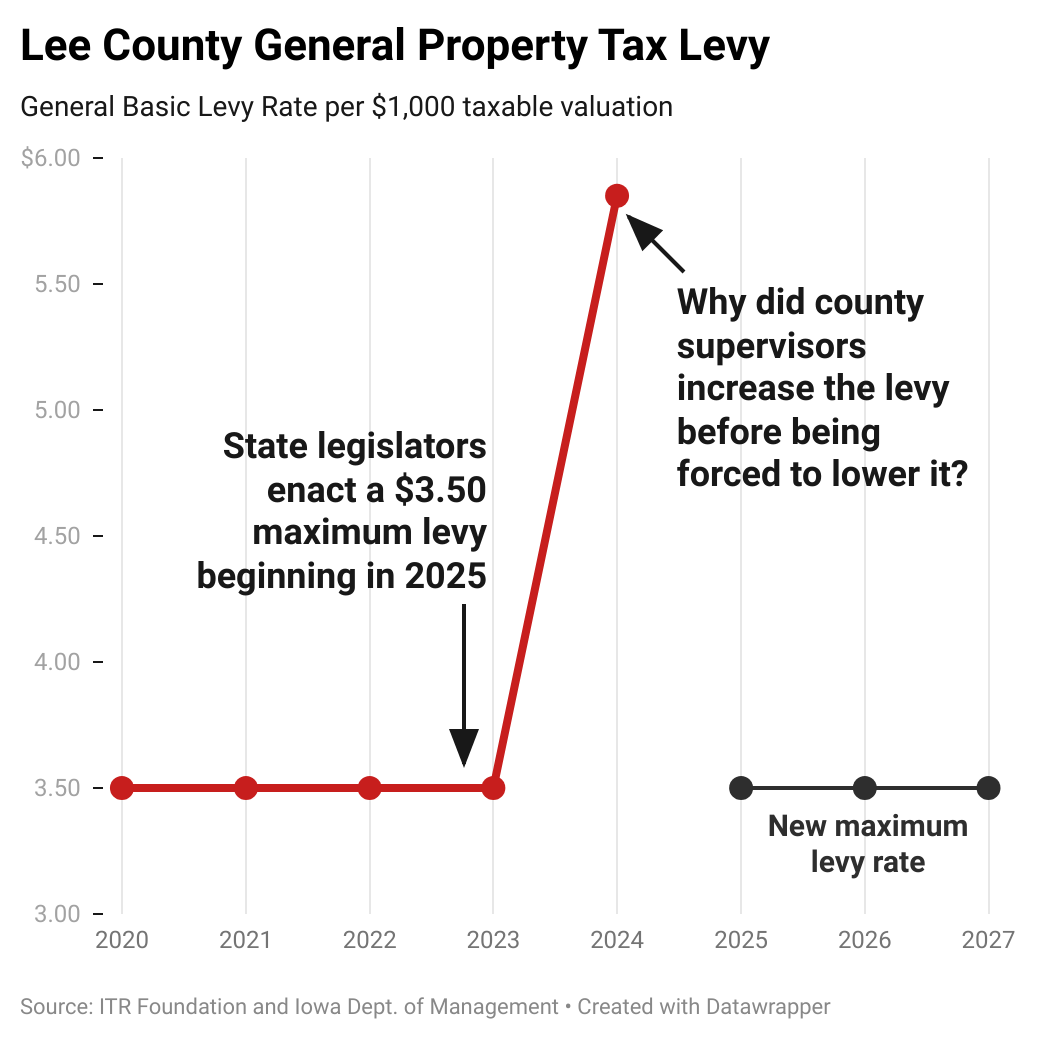

Why did some county supervisors increase a property tax levy right before they will be forced to lower it?

The Governor and Legislators Set a Ceiling

Part of last year’s property tax reform bill set the maximum levy amount for two county levies:

- $3.50 per $1,000 for General Services Levy (for the whole county)

- $3.95 per $1,000 for Rural Services Levy (for rural areas only)

The legislation included a path to gradually reduce rates to the maximum levels for the 33 counties already higher than those amounts.

Some County Supervisors Gouged Family Budgets

The reform bill was passed before county budgets were finalized, and some county supervisors chose to gouge taxpayers by increasing those levies in the last year they could.

Now, 45 counties have at least one of those levies above the maximum. There were 13 counties at or above $3.50/3.95 in 2023 and had at least a $0.20 increase in 2024.

While these counties may give different sorts of justification, for frustrated property taxpayers, their promised relief once again seems elusive.

Lee County had the largest increase. After four years with a general services levy set at $3.50, supervisors increased it to $5.85.

Decatur County has the highest general services levy, Audubon County has the highest rural levy, and Clarke County has the highest combined levies.

Use the maps below to see how your county compares. Counties in blue increased levy rates.

Deja Vu All Over Again

This isn’t the first time some county supervisors took advantage of tax relief passed by the state, increased property taxes, and cashed in.

In 2022, after the county mental health levy was removed from property taxes and paid for by the state general fund, 48 counties didn’t pass on the tax cut to property owners. Instead, they chose to increase the amount taken from taxpayers and spend every dollar they could get their hands on.

Take Action!

The state legislature can only do so much to reduce the property tax burden on Iowans. Citizens must talk with their local elected officials and let them know how government spending impacts family budgets.

Visit itrlocal.org, look for the “Click to Contact Supervisors” link under the line chart, and send them a message.

Watch this episode of the ITR Live podcast for an in-depth discussion about property taxes and local government budgets: