Too often, local governments choose to spend every last dollar from taxpayers they can get their hands on. They should instead be laser-focused on keeping the growth of spending to what Iowa families can afford.

Where is the property tax relief?

Unfortunately, for many Iowans, they won't find any. County Supervisors in some Iowa counties played a shell game and did not pass along the state's full amount of property tax relief. How did this happen?

A property tax levy was eliminated.

In 2021's tax reform bill, the legislature decided to have the state's general fund start picking up the tab for mental health funding. By removing that cost from the county budget, the mental health levy was completely removed from property taxes to give Iowans a little bit of much-needed property tax relief.

Last year, mental health levies ranged from $0.12 (Audubon County) to $0.58 (Wapello County). Setting aside any discussion of valuations and assessments, it is a reasonable expectation that county property tax rates would be cut a comparable amount in each county this year.

Some counties didn't pass on the tax cut.

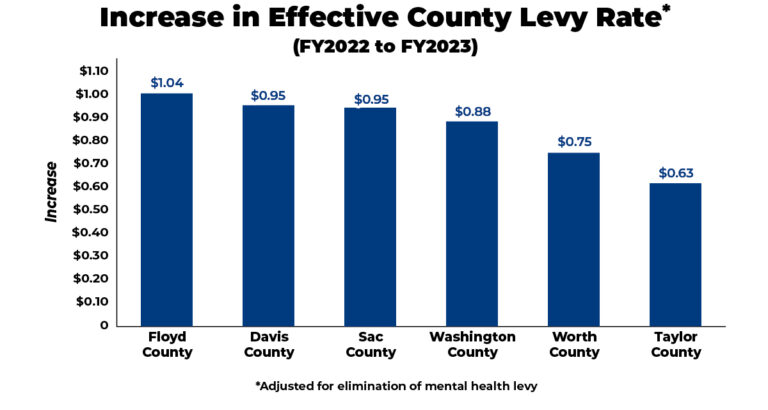

However, that didn't happen in some counties. For example, eliminating Floyd County's $0.33 mental health levy didn't lead to a tax cut. Instead, County Supervisors increased the total levy by almost $0.71, creating a net county levy rate increase of $1.04.

They aren't alone. The chart below shows the next five counties with the largest effective county property tax levy increase.

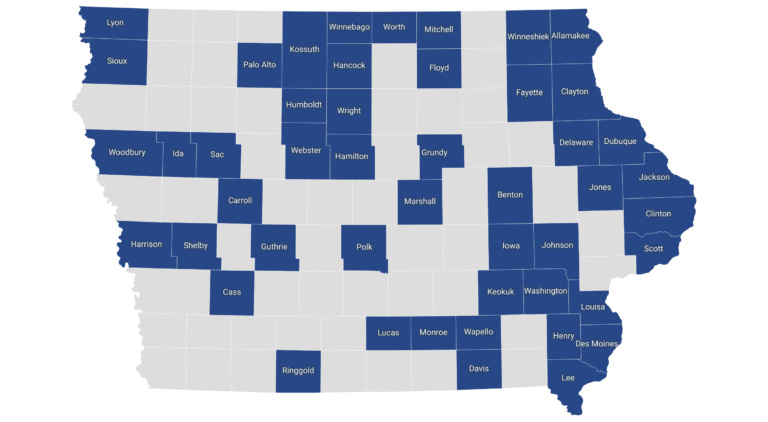

Below is a map showing all 48 counties that withheld the mental health savings from their citizens:

What about your county? Did your county let you have the savings?

Use our interactive map to help you see how each county handled the mental health savings.

The state legislature can only do so much to reduce the property tax burden on Iowans. Citizens must talk with their local elected officials and let them know how government spending impacts family budgets.

ITR Foundation President Chris Ingstad said, "As we think about future tax reforms, this is a warning to legislative leaders about moving too many things to the state General Fund with the goal of providing property tax relief. Whatever savings the state tries to deliver, local governments quickly swallow that savings up."

Iowans are frustrated!

Too often, local elected officials hide behind increasing assessment windfalls as they refuse to reduce levy rates and allow property tax bills to grow.

Many local governments are on a spending spree as Iowans tighten their belts to pay for an increased cost of living and increasing property tax bills.

Property tax statements will soon arrive in mailboxes. It is too late to change this property tax bill, but take action for next year's tax bill.

County supervisors, city council members, and school board members should be laser-focused on keeping the growth of local government spending within the means of what Iowa families can afford. Instead, they choose to spend every last dollar from taxpayers they can get their hands on.

Any chance Iowans have to control the growth of property tax bills starts with fiscal responsibility.

Take action!

Send a message to your county supervisors at ITR Local. Select your county and send them a message with the click of a button.

Learn more:

Listen to today's ITR Live podcast for more insight into property taxes.