Property Tax Limits

Iowans are frustrated with their property and income tax burden.

In too many communities, the cost of government is climbing much faster than Iowans’ ability to pay for it.

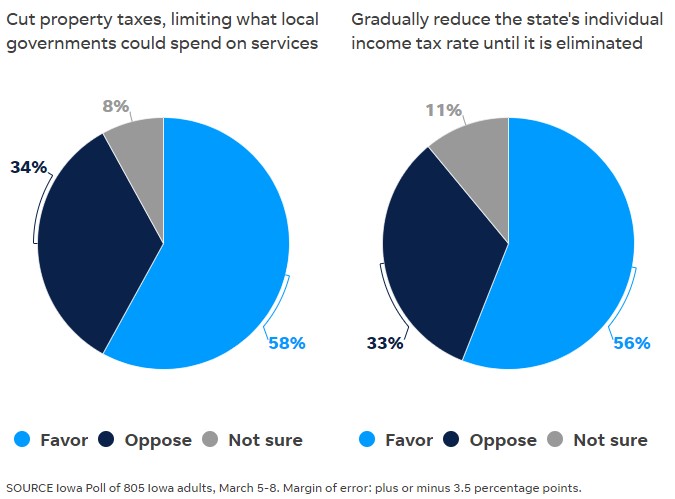

A recent Des Moines Register Iowa Poll found that:

- 58 percent of Iowans support cutting property taxes and limiting what local governments can spend on services

- 56 percent favor reducing and eliminating Iowa’s individual income tax

These issues and solutions are exactly what ITR has been talking about at the Capitol this year.

Property Taxes Limits

The Iowa House and Senate have separate bills addressing the number one issue legislators heard while campaigning and knocking on doors before the election last fall.

House File 1 set the stage as the first bill they introduced in January. House leadership is taking the issue seriously, but the bill is yet to move forward in committee.

In the Senate, SF 356, a bill that would significantly change Iowa’s property system has been passed out of the Ways and Means Committee. If passed, the legislation would consolidate many property tax levies and automatically ratchet down levy rates as assessments increase.

ITR’s team at the Capitol continues to talk with key policymakers, and we know that property tax reform remains a top priority. Tax policy is usually one of the last issues addressed during the legislative session, but lawmakers will start hearing from Iowans when new property assessments arrive in mailboxes around April 1st.

Increased Assessments Aren’t the Problem

Don’t blame the assessor. The problem is local government spending causing property tax bills to grow.

In too many communities, the cost of government is climbing much faster than Iowans’ ability to pay for it.

If your property’s assessment increases by 20 percent, it doesn’t cost local governments 20 percent more to provide the same level of services! Local elected officials should reduce levy rates so their budgets reflect a community’s population growth and inflation.

Local governments have proven they won’t do the hard work of limiting themselves. Now, it’s up to the state to do it for them.

This is a high priority in both the Iowa House and Senate. ITR is optimistic that a meaningful bill restricting local government spending will happen this year.

Income Tax Elimination

This week, a bill that gradually reduces the income tax to zero passed out of the Senate Ways and Means Committee. There was spirited discussion along party lines, but it’s the right direction for Iowa. And, going back to the Iowa Poll results, it’s what Iowans want.

There will be a real conversation this year and again next year about moving to eliminate Iowa’s individual income tax.