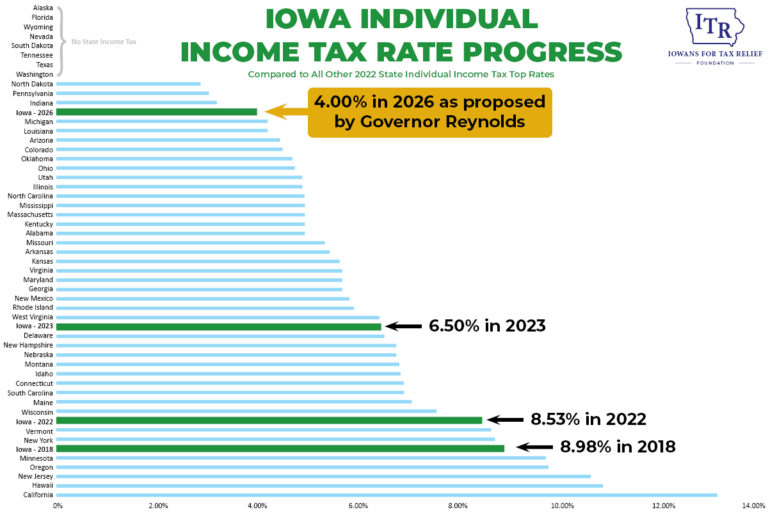

This is a big deal. We now can see that Iowa will have one of the lowest income tax rates in the country within five years.

Yesterday, January 27, the Senate and House Republicans released their tax reform bills on the heels of the governor's proposal last week. When comparing the bills, it's clear Iowa will move to a flat individual income tax rate of no more than FOUR PERCENT, and maybe even lower.

Take a look at how the reform plans compare in the text below or download ITR's Tax Plan Comparison PDF.

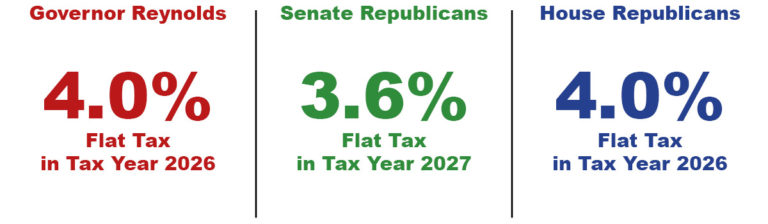

Individual Income Tax

Governor Reynolds kicked off the legislative session with a bold plan to lower Iowa’s individual income tax to a flat 4% by 2026. The Senate Republican plan released earlier this week is similar in concept, takes one additional year to fully implement, and ends up with a lower rate of 3.6%. The House Republican plan on individual income tax mirrors the governor’s proposal.

All three plans operate in the same way, lowering the top marginal rate in each successive year and compressing the brackets until all that is left is the single flat rate. Here is our in-depth analysis of how the governor’s plan works Governor’s Tax Plan By The Numbers.

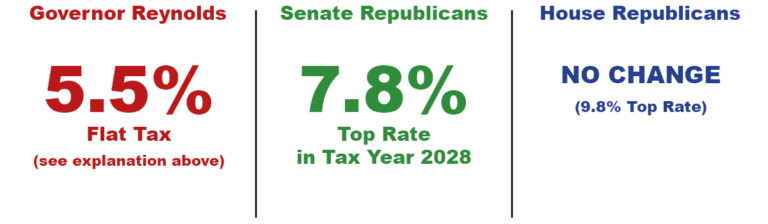

Corporate Income Tax

Governor Reynolds’ plan caps corporate income tax receipts at $700 million. The amount of receipts in excess of $700 million becomes the basis for future annual rate reductions until eventually reaching 5.5%. Once reaching 5.5%, the cap is lifted, and revenues are again allowed to grow.

The Senate Republican plan lowers corporate income tax to a two-tier system. The first $100,000 is taxed at 5.3%, while all income over $100,000 is taxed at 7.8%. The House Republican bill is silent on corporate income tax.

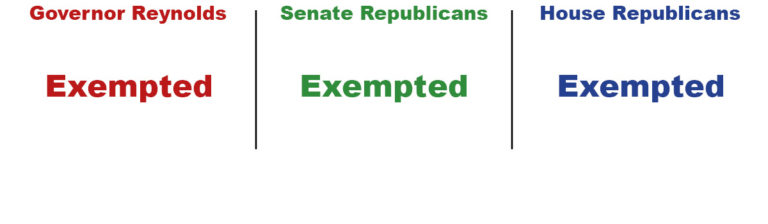

Retirement Income

Both the Senate and House Republican tax bills include the same language proposed by the governor, which excludes retirement income from individual income tax.

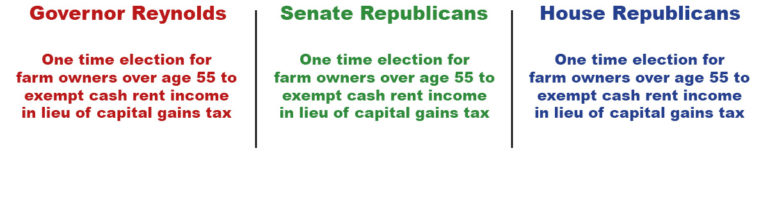

Farm Income

All three proposals include the governor’s language, which extends farm income to the retirement income exemption. The proposal gives a farm owner over the age of 55 the option to exempt cash rent payments from the calculation of overall income for state income tax purposes. The election would be taken in lieu of a future capital gain exemption for sale of the land.

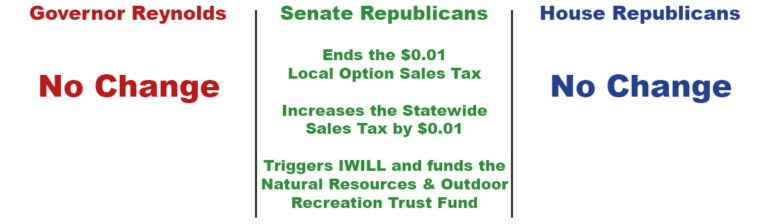

Sales Tax

The Senate Republican plan includes a proposal to end the one-cent Local Option Sales Tax and swaps it for a new corresponding one-cent increase to the statewide sales tax. For the vast majority of Iowa, this results in no tax change but does trigger the funding of the Natural Resources & Outdoor Recreation Trust Fund (IWILL).

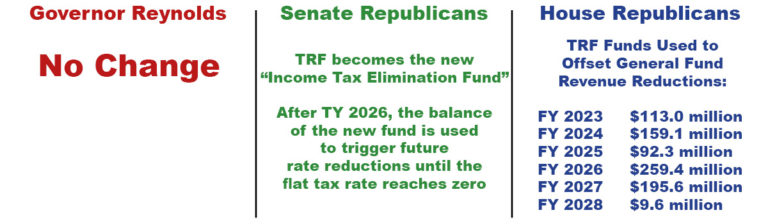

Taxpayer Relief Fund (TRF)

As ITR has emphasized, the current balance of the Taxpayer Relief Fund (TRF) is over $1 billion, with the Revenue Estimating Conference projecting almost an additional $1 billion at the end of the current fiscal year.

Senate Republicans have proposed renaming the TRF to the “Income Tax Elimination Fund” and using the fund balance to trigger future rate reductions until reaching full elimination of the individual income tax. The House Republican bill draws down a total of $829 million from the fund to offset general fund revenue reductions from income tax reductions.

The Big Picture

The ceiling is four percent for our individual income tax rate. Within the three bills, the debate will be about how to use the $2 billion sitting in the Taxpayer Relief Fund, how much state spending is restrained, and if we can go even lower.

As proposed, all three of these plans let Iowans keep more money in their bank accounts and move our state in the right direction.

Take a look at where Iowa would rank if we simply enacted the 4% flax tax, as first proposed by Governor Reynolds:

Iowa would have the country's 12th lowest income tax rate, and eight states ahead of Iowa don't levy an individual income tax.

The House and Senate plans released this week combine for over 200 pages of legislation. We will continue to analyze the details and keep you updated.