“Ratchet-Down” Levy Rates

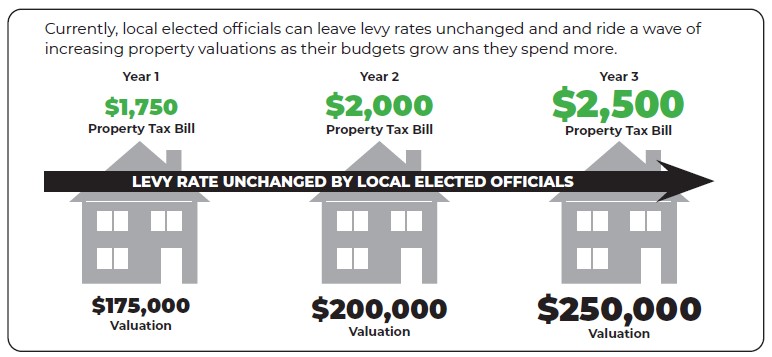

The Problem:

Currently, local elected officials can leave levy rates unchanged and ride a wave of increasing property valuations as their budgets grow and they spend more.

Local elected officials regularly make the claim that they have not raised taxes on local property owners, yet most property owners find that they are paying more in property taxes every year. This is due to the growth of property assessments. When property assessments increase, and local elected officials leave levy rates unchanged, they ride a windfall of new money in the form of tax increases on local property owners.

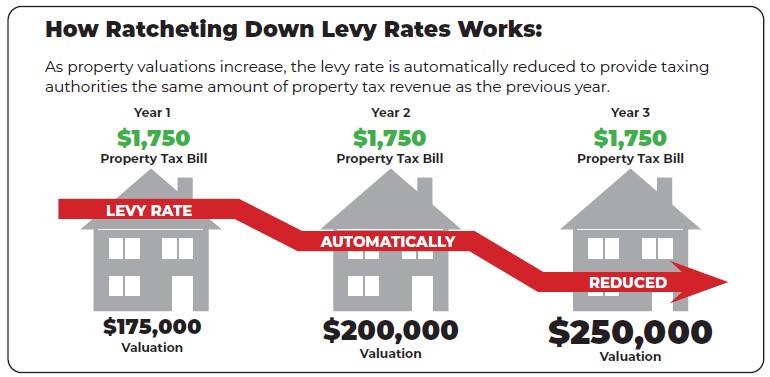

To close this honesty gap, legislators should consider implementing a “ratchet” on levy rates when property assessments are done. When valuations on existing properties increase, local levy rates should be forced down in direct correlation with property assessment increases among existing properties, generating the same amount of revenue for local governments but holding tax bills the same on average. Local elected officials could choose to raise the levy rate, but they could no longer continue making the claim that they have not raised taxes if they choose to reinstate higher levy rates.

The Solution: