Iowa’s Fiscal Sanity In A Crazy World

“I would put what we have been able to accomplish over seven years against any other state in the entire country over that time period.”

– Senate Majority Leader Jack Whitver

It is astonishing to see what is happening to this nation and in many different states and communities. The fiscal turmoil and social unrest directly result from bad policies implemented by elected officials.

Not in Iowa

Our state’s leaders have used good policy to make Iowa a shining state on a hill.

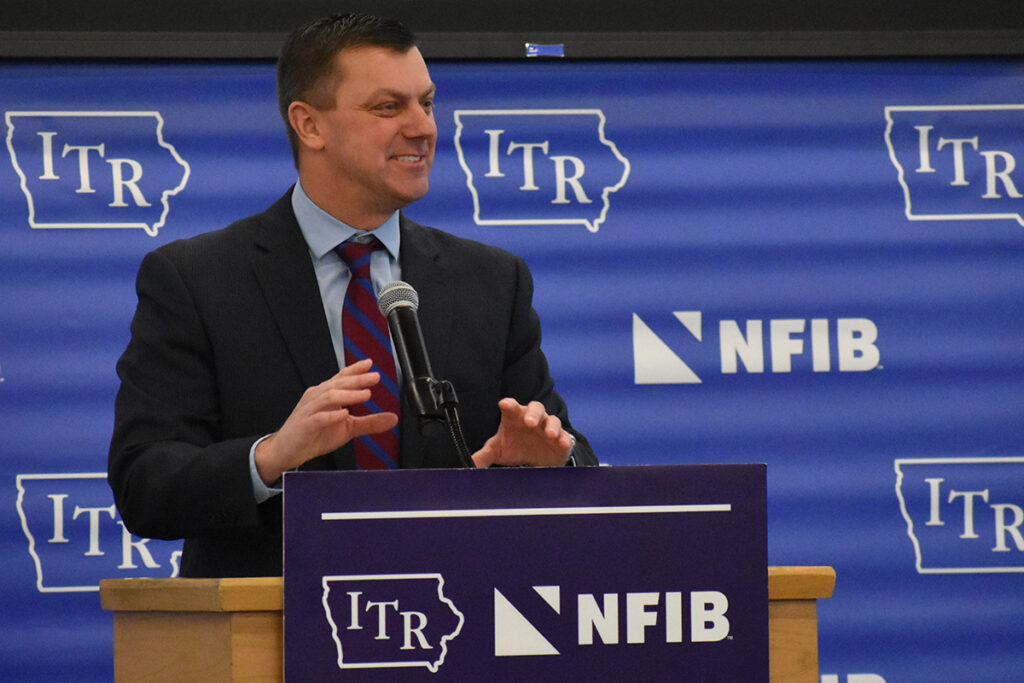

At our annual ITR-NFIB Tax Day Luncheon this week, we heard from three strong conservative voices who have and will continue to influence Iowa’s future.

Listen to the ITR Live podcast for a more in-depth analysis of their comments, but here are some highlights and meaningful quotes.

Senate Majority Leader Jack Whitver said he “would put what we have been able to accomplish over seven years against any other state in the entire country over that time period.”

What are those accomplishments? He listed some of them:

- A record budget surplus

- Record low unemployment

- $2.7 billion in the Taxpayer Reserve Fund

- Record job openings ready to be filled

- We were the strongest state going into COVID

- We have had the fastest recovery from COVID

After listing the accomplishments, Whitver added, “I would say that right now in Iowa, we’re in the strongest position we have ever been in as a state.”

What About Property Taxes?

Iowa taxpayers have benefitted from the state legislature limiting spending in recent years. Spending restraint is what made income tax cuts possible.

It is critical that local governments follow the example set by the state and do the same thing to stop runaway property tax bills.

House Ways and Means Chair Bobby Kaufmann pointed out the sky is not falling on local government budgets. Kaufmann said, “When we debated the assessment bill last week (SF 181), all that was, was a correction. As far as I’m concerned, what was happening with the lobbying up at the Capitol was lobbying malpractice. The cities have more money in their reserve accounts than the state of Iowa.”

“As far as I’m concerned, what was happening with the lobbying up at the Capitol was lobbying malpractice.

The cities have more money in their reserve accounts than the state of Iowa.”

-Rep. Bobby Kaufmann,

House Ways and Means Chairman

Kudos to Chairman Kaufmann for understanding the actual numbers, which ITR worked hard to provide, and passing the right policy to prevent a $134 million property tax increase for Iowans.

How Much Does All Government in Iowa Cost You?

Iowa’s General Fund is roughly $8.5 billion. However, that is just part of what government in Iowa costs you. What’s the total when local governments like cities, counties, townships, and other political subdivisions are included?

$43.9 Billion!

Kraig Paulsen, Director of the Iowa Departments of Revenue and Management, shared that the total cost to operate all levels of government in Iowa was $43.9 billion in 2019, the most year with available data. Click here to read the report.

That is $13,700 for every man, woman, and child in the state. Or, as Paulsen calculated, $750,000 for every square mile in Iowa.

Iowa’s Budget

Director Paulsen talked about Governor Reynolds’s proposed budget and her recommendation to spend $8.5 billion.

He said, “Some of this is government math. And since we don’t have that much time, I want to explain it all to you. But what is available to spend because of carryforwards is about $10.4 billion. Her proposal is to spend just under 82% of the available resources. I will tell you, this is what makes this work as the tax rates come down, you keep the spending low and those lines will come closer together.

“The state has been strong and continues to be strong this year. There are going to be some opportunities. But again, that takes great discipline on everybody’s part.”

-Kraig Paulsen,

Director of the Iowa Departments of Revenue and Management

As Iowa implements the tax reforms passed over the last couple of years, the state will still collect enough money to pay for its obligations, and there will still be opportunities for more tax relief.