How Low Can Iowa’s Income Tax Rates Go?

The income tax is a harmful tax on productivity and success, and Iowa is currently on the path to go from one of the highest individual income tax rates in the nation to one of the lowest.

Over the last six years, conservative budgeting has starved the beast of state government spending. Now, Iowa is strongly positioned to enact even further income tax reform.

As lawmakers returned to the Capitol this week, Governor Kim Reynolds, Senate Majority Leader Jack Whitver, and House Speaker Pat Grassley all indicated they want to continue improving Iowa’s tax code.

Governor Kim Reynolds – Go Further, Faster:

“Our most recent income-tax bill established a flat rate of 3.9%, set to phase in gradually until finally taking effect in 2026. As always, it was an aggressive, growth-oriented policy on a responsible, conservative timeline.

And once again, opponents said that letting Iowans keep more of their money would break the government. One left-leaning group called it a “recipe for disaster.”

Well, that was wrong. Two years later, it’s clear that we are well-positioned to go further, faster.

Even with the tax cuts we have already delivered, state revenue continues to grow, ending the year with a $1.83 billion surplus and more than $900 million in reserve funds.

Let me be absolutely clear: the surplus does not mean that we aren’t spending enough; it means we’re still taking too much of Iowans’ hard-earned money.

Tonight, I’m proposing a bill that reduces the income-tax rate to a flat 3.65%, while allowing it to take effect this year, retroactive to January 1st. The following year, in 2025, the rate would fall again to flat 3.5%.

This bill represents a total savings of almost $3.8 billion for taxpayers over the next five years. And it gets there by cutting taxes for every Iowan who pays them.”

This is a significant tax cut! A 3.5 percent income tax rate would move Iowa to the 12th lowest in the country and the third lowest of all states with an income tax. (Nine states do not have an income tax.)

House Speaker Pat Grassley – Deliver Relief As Soon As Possible:

“Bidenomics has hit Iowans’ pocketbooks hard. House Republicans want to deliver relief that Iowans can feel as soon as possible. If you’ve come to know anything about our caucus’ tax proposals, you know it will be sustainable.

This session, we’ll look at speeding up our previously passed tax cuts as quickly as we can.”

Senate Majority Leader Jack Whitver – Cut, Control, and Reform:

“This legislative session, we are going to stay on this path forward, making Iowa a model for other states. We will expedite the tax cuts so Iowans keep more of their money sooner. We will condense the number of income tax brackets making taxes simpler and fairer. And we will responsibly manage our budget to focus on the necessities and maintain the principle of putting the taxpayer first, not the government.

In one sentence, here’s the plan: cut taxes, control spending, reform government, and let Iowans be great.”

The House and Senate leadership clearly want to cut rates, too, and will probably have their own proposals. ITR will keep you informed with emails, social media, and in-depth analysis on the ITR Live podcast.

ITR’s Plan – Accelerate, Lower, and Eliminate:

Iowa cannot become complacent. The competition among the states for businesses, jobs, and people is fierce.

In our 2024 Legislative Issue Guide, ITR has a three-part plan to accelerate, lower, and eliminate the state income tax:

- Accelerate existing rate reductions.

Accelerating the existing tax rate reductions to get to the 3.9 percent flat rate before 2026 is possible due to built-in budget growth. This would allow policymakers to establish a lower flat tax rate. - Continue to lower rates.

The short-term goal should be a 2.4 percent or lower flat tax, which would be the lowest flat tax in the nation. Arizona currently has a 2.5 percent flat tax. If needed, use the Taxpayer Relief Fund to supplement revenue. - Create a path to eliminate the income tax.

The overcollection of taxes from Iowans has increased the Taxpayer Relief Fund to an estimated 3.6 billion in 2024. Use this fund to supplement revenue to gradually reduce rates with the goal of eliminating the individual income tax.

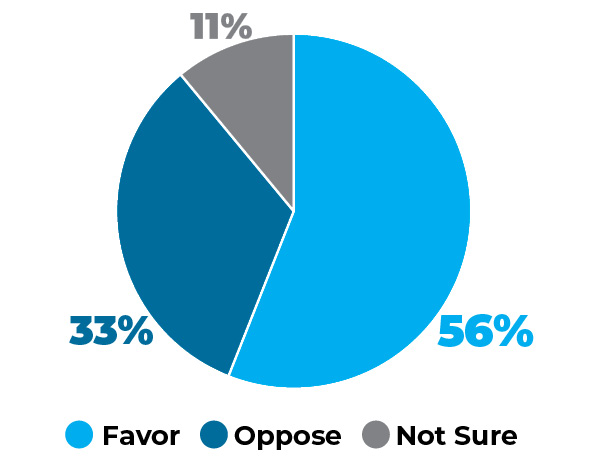

A March 2023 Des Moines Register/Mediacom Iowa Poll shows a majority of Iowans support legislation to reduce income taxes.

Do you favor or oppose gradually reducing the state’s individual income tax rate until it is eliminated?

Iowa is setting the gold standard that other states want to follow. However, we must not become complacent. Taxpayers deserve to keep more of their hard-earned income!