Did You Get Your Property Tax Bill Yet?

New property tax bills will soon arrive in your mailbox. It’s too late to change this bill, but at a time when Iowans are buckling down and budgeting to save money, local governments should do the same.

A new property tax statement will arrive in your mailbox as you get ready to go back to school, watch the college football season kickoff, and bring in the harvest.

What’s irritating is that it is too late to do anything about this bill!

City councils, county supervisors, and school boards determined this bill’s amount last year when they chose how much of your money to spend.

Cities are spending 78% more now when compared to 10 years ago.

Counties spend a good amount of property taxes, too. $3.2 billion statewide, to be exact.

Not only are local governments spending your money today, but they have also committed to future spending and burdened generations to come. Iowa’s debt has increased to its largest amount in nearly a decade. Cities alone have over $7.5 billion in outstanding debt obligations, while our K-12 public schools have over $5 billion.

Your Local Government Debt:

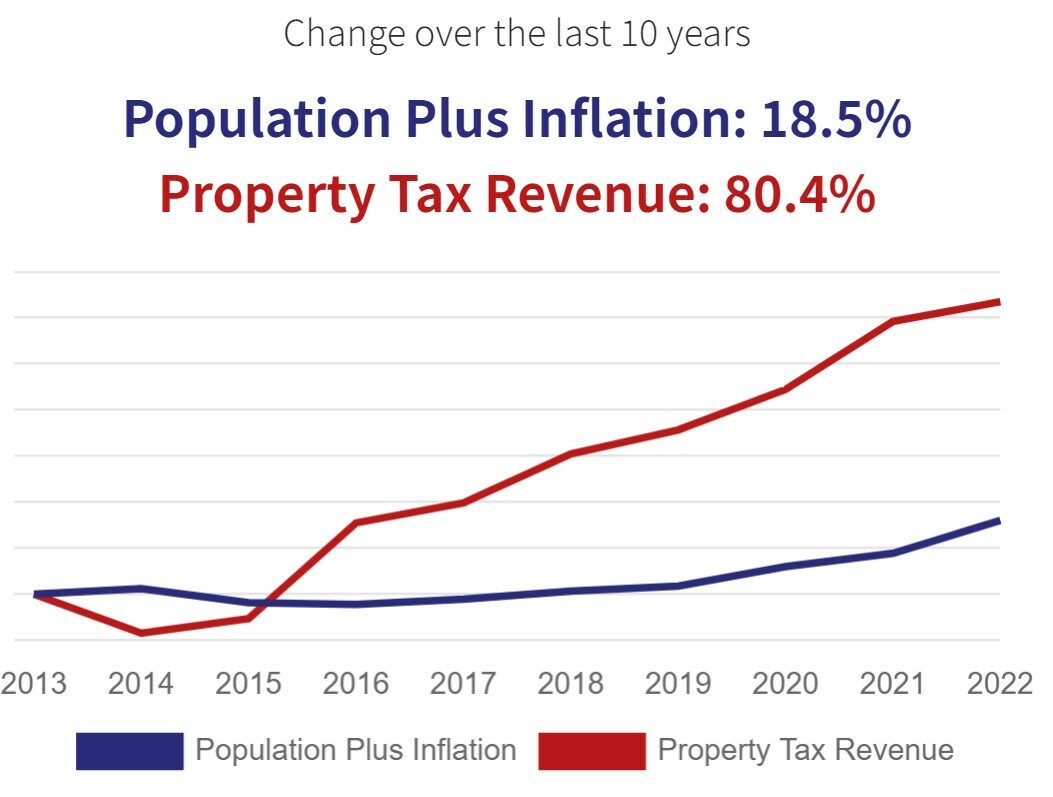

In Iowa, we expect to receive quality public services at a reasonable cost. However, there is a gap between the amount of property taxes extracted from citizens and the community’s growth in many parts of the state.

Is this your community?

At a time when Iowans are buckling down and budgeting to save money, local governments should do the same. A reasonable property tax growth rate would be close to the combined percent increase of inflation and the county’s population.

What about the new assessments?

Property taxes are complicated and confusing because the amount of your most recent tax bill was determined over a year ago. The Iowa Department of Revenue lists 22 steps in the 18-month property tax cycle.

New assessments mailed this April will impact what you pay in September 2024 and March 2025. Local government budgets and spending choices have already been made. Once again, it’s too late to change those.

The Iowa Legislature passed, and Governor Reynolds signed, a property tax reform bill in May. It’s too early to say just how impactful these new reforms will be, but this bill is an excellent first step and will add transparency to Iowa’s complex property tax system.

The best way to control the growth in local government spending and property taxes is to get involved and hold local elected officials accountable.

Impact future tax bills by starting a conversation with your city council, county supervisors, and school board members in person or through ITR Local. Remind them that government budgets shouldn’t grow faster than family budgets!