Good tax policy means people can improve their financial situations faster than the government grows.

This week, we've seen way too many headlines announcing another cancellation. Do you know one cancellation notice we haven't seen yet?

Canceled: high tax rates

There is a long-term economic risk if our policymakers or the public continue with inaction and lack of urgency for income tax reform.

High income taxes will continue to act as a flashing “Keep Out” sign to people from out of state. Have you paid attention to our state’s population? People aren’t exactly flocking across our borders.

So, can we just cut spending and cut taxes?

Sure, but the reality is spending won’t be solved in one year in Iowa’s legislature. Spending changes alone also can’t be the sole tool to fix an income tax burden well above the national average. According to the Tax Foundation's 2020 Business Climate Tax Index, Iowa’s income tax burden ranks 42nd in the country, and Iowa’s tax climate ranks 42nd overall.

Can income tax reform that isn’t accompanied by major spending cuts actually work?

Of course it can. Let’s look at what North Carolina has been able to accomplish since they tackled income tax reform in 2013. Prior to reforms in the Tar Heel State, North Carolina was ranked 44th in the Tax Foundation’s 2012 Business Climate Tax Index.

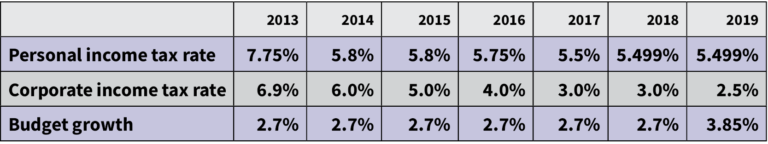

By combining a series of revenue triggers, expanding the sales tax base, and capping or eliminating tax credits, North Carolina steadily reduced its top personal income tax rate from 7.75% to 5.499% and reduced its top corporate income tax rate from 6.9% to 2.5%. North Carolina ranks 15th in the Tax Foundation’s 2020 Business Climate Tax Index.

North Carolina Tax Rates Reduction and Budget Growth:

While North Carolina was improving their tax code, the state budget kept growing at a rate of 2.7% in most years.

Tax reform isn’t always about slashing government’s budget--it’s about crafting a tax code that promotes growth, rewards productivity, and allows citizens to keep more of their hard-earned money. Government budgets can grow alongside the incomes of the people who fund them, while those individuals are able to keep a greater percentage of their income.

Controlling the growth of spending is necessary and reasonable, but good tax policy does not necessarily mean that the amount of revenue a state takes in will shrink; it simply means that the people of a state are able to improve their financial situations more rapidly than the government budget grows.