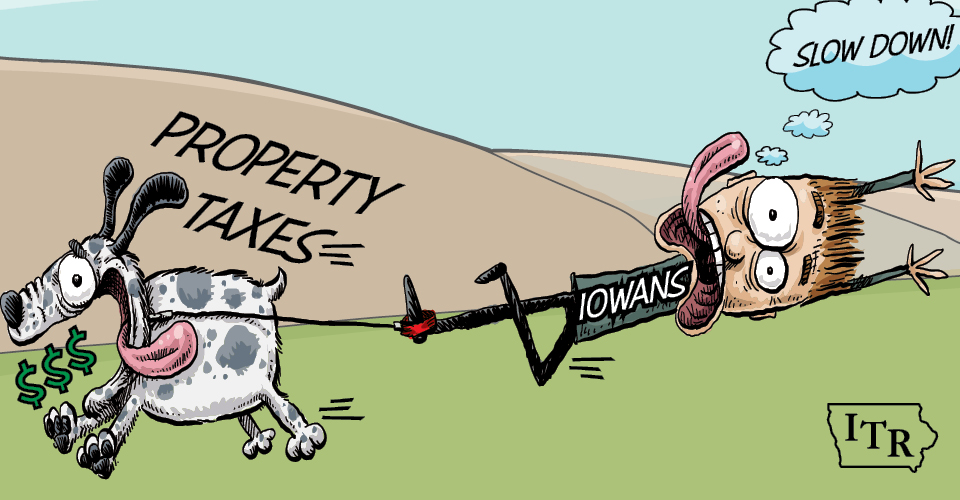

What is a Property Tax Revenue Cap?

A revenue cap is a limit on how much total property taxes collected by local government can grow each year. ITR proposes a limit of 2 percent or the rate of inflation, whichever is less.

If a local government wants to exceed the cap, local elected officials must justify to their citizens why spending more tax dollars is necessary and cast an affirmative vote on that tax increase after a public hearing process. This would preserve local control and encourage cost savings.

What About Property Tax Assessments?

When considering property tax reform, a popular target is the assessment process and assessors. While, the assessment should be as fair and accurate as possible, focusing only on the assessment misses the root of the problem- how much money local governments are spending!

Solely addressing assessments creates inequalities, distorts the valuation of property, and creates tax shifting and other unintended consequences. Limits on assessments do not necessarily limit the growth of local government.

Why Not Freeze My Property Tax Bill?

A common response to property tax reform is to freeze, exempt, or eliminate property taxes for various classes of people. This is basically having the government pick winners and losers among property taxpayers. Any solution to unaffordable property taxes must benefit everyone. While the desire to do so is understandable, targeted freezes or exemptions merely shift the burden to other taxpayers.

National Organizations Support ITR

This week, two national taxpayer organizations joined ITR in support of a property tax revenue cap.

Americans for Tax Reform President Grover Norquist co-wrote an op-ed with ITR President Chris Ingstad. In the article they stated,

“Lawmakers in Iowa should also do everything in their power to keep local tax bills in check, as high local taxes are also a deterrent to businesses and investment. One way to accomplish this is to implement local spending limits that require spending growth to be no more than population growth and inflation.”

Read more at The Iowa Standard

National Taxpayers Union President Pete Sepp joined Ingstad in sending letters to Iowa House and Senate leadership encouraging them to enact a property tax revenue limit. The letters offer suggestions of how to tackle high property taxes including:

- Supporting a cap on future property tax revenue growth.

- Setting a supermajority. Most successful property tax limits impose a high “override” requirement on the local governing body.

- Increasing public input and transparency.

- Ensuring assessed values reflect market values.

- Implementing an extensive public hearing process should also be strongly considered as part of the property tax solution.

Taxpayers Are Speaking Up

Put a cap on property tax revenue

Read Mason City Globe Gazette Letter to the Editor

Prioritize legislation ‘before the residential property taxes are out of control’

Read Adel News Letter to the Editor

Tell your property tax story! Use the button below to easily send a letter to the editor. Start with one of our templates or write your own. Our action center will send to your local papers based on your address.

Property Tax Reform Bill Introduced

Wednesday, the House Ways and Means Committee introduced a property tax reform bill, HSB 165. It appears the bill:

- Establishes a budget limitation for cities and counties.

- Contains an override mechanism for local officials to exceed the established limit. If they choose to do so, citizens would have the right to call for a reverse referendum if they disagree with local elected officials’ actions.

- Encourages, but does not require, some budget reforms for cities and counties.

We will continue to examine the bill and will have a more detailed analysis in next week’s Watchdog email newsletter.