The Iowa House and Senate passed legislation to cut income taxes by almost $2 billion over the next four years. Now, Iowa taxpayers are the governor's signature away from the most significant tax relief in Iowa history.

We knew this would be a good week when Governor Kim Reynolds was speaking at our Tax Day lunch on Tuesday. It is always nice when the governor thanks ITR and calls the organization "incredible, indispensable partners in this ongoing effort."

Yesterday, that ongoing effort achieved a fantastic victory: The most significant tax reform in Iowa's history was sent to the governor's desk.

Victory

Two months ago, we said, "It's time to end the massive overcollection of Iowans' money and cut our rates. Anything less than a major tax cut is a slap in the face to every Iowa taxpayer."

Well, the major tax cut is going to happen.

The Iowa House and Senate passed legislation yesterday to cut income taxes by almost $2 billion over the next four years. Now, Iowa taxpayers are the governor's signature away from the most significant tax relief in Iowa history.

When fully implemented, the tax reform will:

- Create a 3.9% flat individual income tax rate

- Eliminate state income taxes on retirement income

- Set a path to reduce the corporate income tax from 9.8% to 5.5%

- Phase-out special tax incentives in the corporate tax code

Read ITR Foundation's explanation of when the rate changes will take effect.

Why Is This A Big Deal?

ALL Iowans will save hundreds or thousands of dollars each year. Taxpayers will keep a meaningful amount of money in their bank accounts.

ITR asked a CPA firm to analyze the governor’s original 4.0% proposal to get a sense of what this would mean for Iowa taxpayers. One example: A family of four earning $60,000 (the median Iowa household income) would save $939 annually. Since the final version of the bill cuts rates even further than the original proposal, those savings will be even larger.

What the legislature approved this week will put real money back in Iowans’ pockets. This is the kind of tax relief that will make a huge difference for Iowa families.

At our Tax Day lunch on Tuesday, Governor Reynolds said:

"There is nothing more vital than seizing the opportunity to return taxpayer dollars back to Iowans. If we pass the reforms that we are talking about, our income tax rate will go from one of the highest in the county to fifth-lowest, and maybe even better, making Iowa one of the most tax-competitive states in the nation. And I believe, a destination for business.

With one stroke, we can reward work that will give a financial boost to our families, support farmers, and keep our retirees in Iowa. It's true, we at the Capitol may have a bit less to spend, but Iowans will invest those dollars in our economy, in our main streets, and our businesses."

How Did We Get Here?

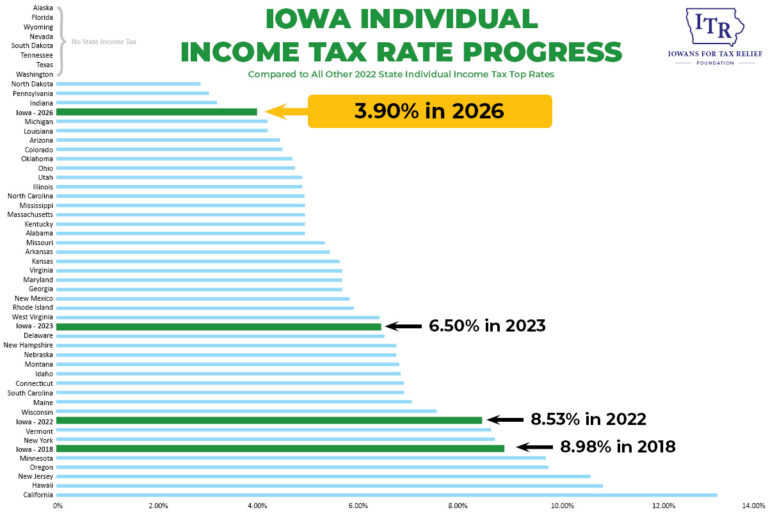

When Governor Reynolds took office in 2018, Iowa's top individual income tax rate was 8.98 percent, the sixth-highest in the nation. That year, lawmakers passed a ten percent across the board tax cut, lowering the top rate to 8.53 percent.

Last year, after signing a bill lowering the top rate to 6.5 percent and eliminating the inheritance tax, Reynolds said, "We are not done yet. Next year we'll be back, and I'll be proposing to cut our personal income taxes even further."

House Speaker Pat Grassley noted, "Before the session, we said we were going to provide real tax relief for Iowans, we have an overcollection of their money, and we're going to get it back in their hands as quickly as possible."

That is what happened. This year, conservative leadership from the governor, House, and Senate pushed hard to elevate tax cuts above other issues and prioritize family budgets.

Senate Majority Leader Jack Whitver said, "We're going to be at 3.9 percent, which of the states that have an income tax will be the fourth lowest in the entire nation. That's a huge improvement from where we started."

Why This Matters

Two reasons:

- You, your neighbors, and every other Iowan will have a lower tax bill and keep more money in their bank account.

- Iowa will become more attractive to businesses and individuals. The state can become a destination for those looking to relocate and keep current residents as the world embraces remote technology.

At the Tax Day lunch, Senate Ways and Means Chairman Dan Dawson shared that this reform "is not just playing catch-up with other states. It will propel us forward and ahead of other states."

What's Next?

It is a constant battle to keep all levels of government out of your pocket and off your back. The government needs only to collect enough taxes to fund our priorities, not over-fund them.

Locally, make your voice heard about local government and property taxes at ITRLocal.org.

At the Capitol, this legislative session is far from over, and there is still more work to be done.