Is Your Property Tax Bill Out of Control?

Have something to say about your property taxes?

Click here to take our survey.

“What I’ve worked 50 years to build up, they’re taking away from me. Pie in the sky assessments allow government to grow and prosper way beyond what property owners and other taxpayers can afford.”

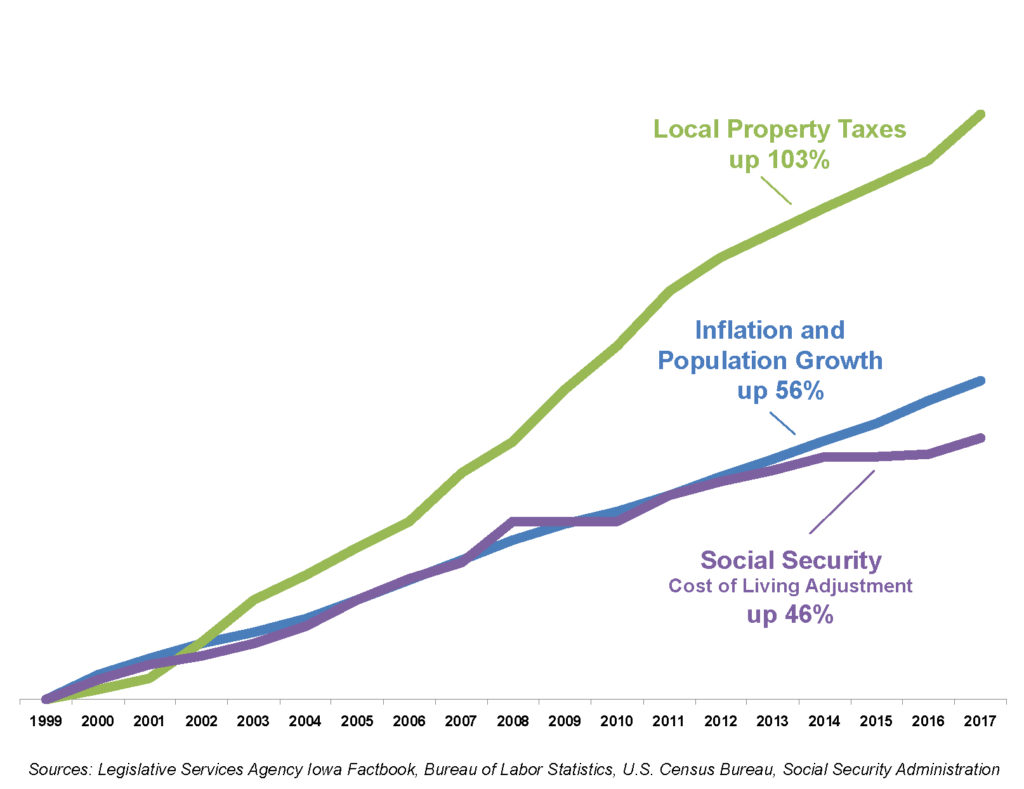

These are comments a retired Iowa veteran recently sent to us and the data backs up his claim about affordability. Since 2000 total property tax revenue across the state of Iowa has increased over 100%. Over that same time, the cost-of-living adjustment (COLA) provided to Social Security beneficiaries has only increased by 46%. This growing property tax burden is painful to all Iowans and especially to our retirees.

Current taxpayer protections are ineffective at keeping property tax bills from increasing. Many local governments have kept property tax rates the same, but are receiving significant tax revenue increases simply because property valuations have increased. Soon, property taxes will become unaffordable. What can be done?

An effective property tax limitation could be based on a fixed percentage, population growth plus inflation, or the Social Security COLA. This would keep taxpayers from receiving large increases in their property tax bills solely because of higher assessments.

The Iowa legislature can help provide taxpayers with property tax relief by establishing a revenue limit on property tax growth. This would not interfere with the assessment process, but it would control the growth of property tax bills while ensuring local governments continue to have enough revenue to fund their priorities.

Property taxes must not be excessive and property owners should not be punished just for owning property.

Share your thoughts regarding property taxes.

Click here to take our survey!

Get more property tax information at taxrelief.org/property-taxes/