Taxpayers deserve a policy solution for property tax relief. The gold standard policy for property tax reform is Truth-in-Taxation, with Kansas and Utah providing the best policy models.

March Madness wrapped up last week with the Kansas Jayhawks being crowned National Champions. While there may not be many Iowans who joined Jayhawk fans in celebrating that victory, there was another win in Kansas that we can all be happy about: property taxes. The map below identifies 21 Kansas counties that actually experienced a decline in property taxes this year.

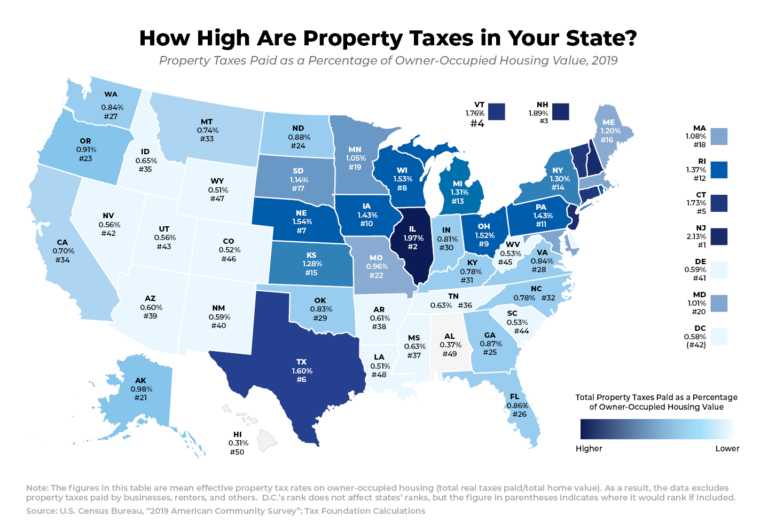

Before examining what caused the big win in Kansas (the property taxes, not the basketball), we should reflect on the property tax situation in our state. Iowans are demanding property tax relief, and nobody can blame them. Even before inflation reached record highs, putting a major squeeze on household budgets, Iowans felt the pain of having a heavier property tax burden than 40 other states.

Here’s just one comment that was sent to us this week that sums it all up:

“Many Iowans like myself would like some relief from high property taxes. We are all struggling with extremely high prices for food, gas, electricity, etc. How are we supposed to live and keep our homes?”

As inflation drives up the prices of those necessities, eating away wages and savings in the process, financial pain becomes more acute. Unfortunately, local governments are failing to address this problem. In fact, even when the state picks up the check for certain services, some local governments won’t pass on the full savings to taxpayers.

Whether Republican, Democrat, or Independent, urban or rural, taxpayers are getting tired of excuses from local governments. Often, they are told that property tax rates are decreasing, while their property tax bills are increasing. And when Iowans receive their new valuations from the county, as many homeowners did recently, the blame for more taxes is incorrectly directed at the county assessors.

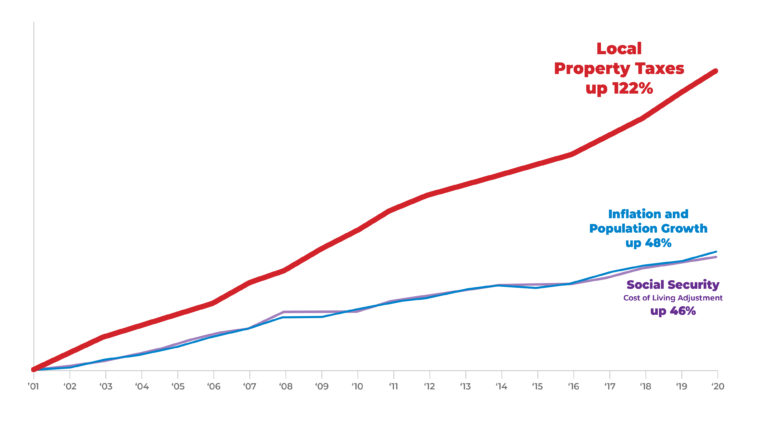

At the heart of high property taxes is government spending. Spending drives higher property tax bills, not assessments. “Holding property tax down requires local officials to spend taxpayer money more efficiently, but not all local officials are willing to do so,” argues Dave Trabert, CEO of the Kansas Policy Institute. Iowans can consider the growth of their property taxes in one of our favorite graphs below.

Taxpayers deserve a policy solution for property tax relief. The gold standard policy for property tax reform is Truth-in-Taxation, with Utah and Kansas providing the best policy models. “What this legislation does is reduce mill (levy) rates. Each year, when new valuations come in, the mill levy is automatically reduced, so that those valuations deliver the same dollar amount of property tax to the city or county. Then, if they want to take in more money, they have to tell taxpayers what they want to do and hold a public hearing and then vote on it,” explains Trabert.

Though passed in Kansas just last year, the law is already delivering for property taxpayers there. In 21 counties property taxpayers will be paying less tax as a result of Truth-in-Taxation, while 47 counties will have net increases under three percent.

“Decisions by local officials to not exceed the revenue-neutral rate (RNR) calculation within Truth in Taxation played a significant role in the declines and small increases. In 19 of the 21 counties with tax declines, most taxing authorities did not exceed RNR. In 32 of the 47 counties with increases below 3percent, most taxing authorities did not exceed RNR,” noted Trabert.

Truth-in-Taxation is a common-sense property tax solution built on honesty and transparency. It forces local governments to be more accountable and they cannot hind behind assessment windfalls. If a local government wants to spend more money, a Truth-in-Taxation hearing has to take place so local officials can justify the new spending and take a public vote.

Truth-in-Taxation is a pro-taxpayer solution for property taxpayers.

This article was originally published by ITR Foundation.