"You shouldn't have to wake up every morning and worry about the next thing the government is going to do to you, your business, or your children." - Governor Kim Reynolds

HF 2317

Passed Senate 32-16 on February 24

Passed House 61-34 on February 24

Signed by the governor on March 1

After signing the most significant tax relief legislation in state history and cutting taxes for every Iowan yesterday, Governor Kim Reynolds made Iowa proud when she gave the Republican response to President Biden's State of the Union address.

In addition to addressing reckless government spending and harmful restrictions and policies of the Biden administration, Reynolds said, "You shouldn't have to wake up every morning and worry about the next thing the government is going to do to you, your business, or your children."

Then, our governor shared with the nation what we already know: Iowa is accomplishing a generational change in how much state government takes from taxpayers.

When fully implemented, the tax reform will:

- Create a 3.9% flat individual income tax rate

- Eliminate state income taxes on retirement income

- Set a path to reduce the corporate income tax from 9.8% to 5.5%

- Phase-out special tax incentives in the corporate tax code

Individual income tax rates will be reduced as follows:

- 6.0 percent (2023)

- 5.7 percent (2024)

- 4.82 percent (2025)

- 3.9 percent (2026)

Governor Reynolds said, "When I took office, Iowa had the sixth-highest individual income tax rate in the nation at 8.98%. I believed Iowans deserved better. With this bill, Iowa is now the fourth lowest for individual income tax rate in the nation."

Senate Majority Leader Jack Whitver added, "This tax bill is the third major tax relief package the Senate has delivered in the last four years. A nearly $1.9 billion tax cut creates an environment for more career opportunities for Iowans, gives Iowans more of an incentive to rejoin the workforce, and helps Iowans weather the impact of record-setting inflation created by the reckless policies coming from Washington, D.C."

House Speaker Pat Grassley offered encouraging words about what the future might hold, “We look forward to, after we’re all reelected, to doing this again moving forward.”

Iowans Support Reynolds and Tax Cuts

The governor is very popular in the most recent ITR Foundation Poll, and Iowans strongly support this tax reform plan.

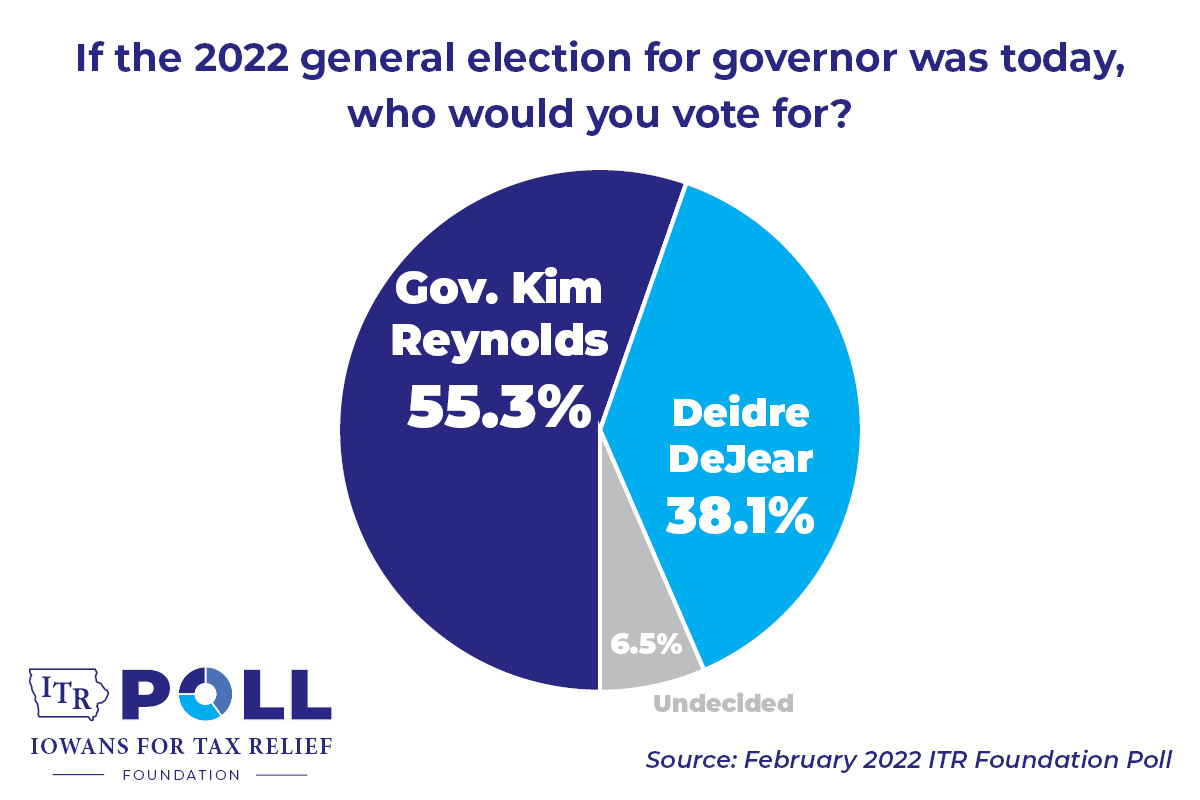

Governor Reynolds has an incredibly high net favorability and was by far the most popular person tested. Reynolds leads by 17 points on the gubernatorial ballot over likely Democrat nominee Deidre DeJear (55.3 to 38.1).

ITR Vice President Chris Hagenow said, "It is difficult to imagine how Governor Reynolds does not sail to re-election in November. Her strong personal favorability is coupled with the overwhelming support for her signature tax proposal."

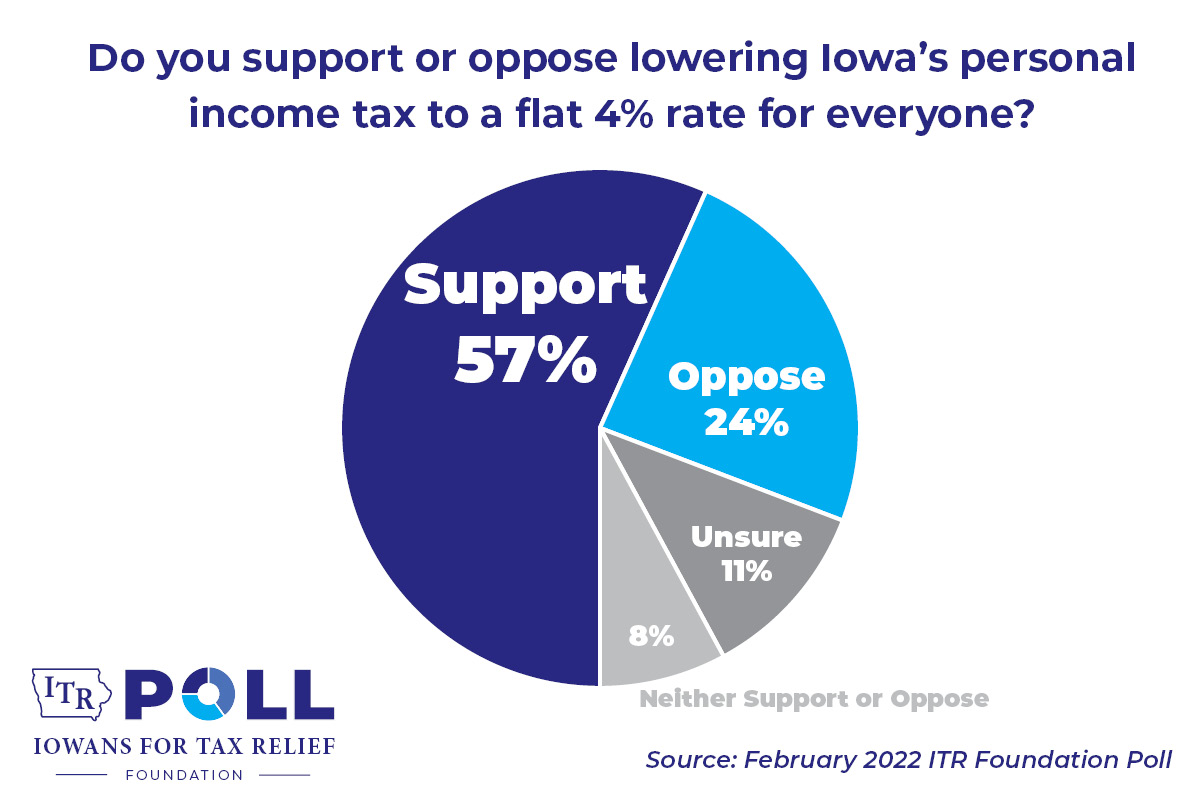

When asked about tax reform, 57 percent of Iowans support the proposal to lower Iowa's personal income tax to a lower flat rate, while only 24 percent oppose a flat tax.

Iowans know our state's tax code takes too much money from taxpayers, and it is not just Republican voters who think that way. The ITR Foundation Poll shows that nearly two out of three unaffiliated voters overwhelming support cutting individual income taxes and creating a flat tax with a rate no higher than four percent.

Tuesday, the headline in a Wall Street Journal article was, "Is This Taxypayer Heaven? No, it's Iowa."

That's perfect. Compared to other states, Iowa is quickly becoming an example of empowering taxpayers and giving everyone the opportunity to succeed.