Property Tax Reform Moves Forward

Last week, the Iowa House and Senate passed separate property tax reform bills with almost unanimous bipartisan support. Will either of these bills fix the root problem—excessive local government spending?

Iowans understand the property tax problem

To control property taxes, two-thirds of Iowans support the legislature setting limits on how much a local government can tax and spend.

Local governments in Iowa spend far too much and keep expecting taxpayers to foot the bill.

Property tax reform advances at the Iowa Capitol

The Iowa House and the Senate want to fix the property tax problem. They hear Iowans’ frustration and are trying to come up with solutions to provide some relief. Last week, each chamber passed different property tax reform bills with almost unanimous bipartisan support.

The one lone “no” vote in the Senate was a liberal Democrat, and the one “no” vote in the House was a pro-taxpayer Republican. That’s evidence there’s a shared interest in doing something because the entire Capitol knows Iowans are angry.

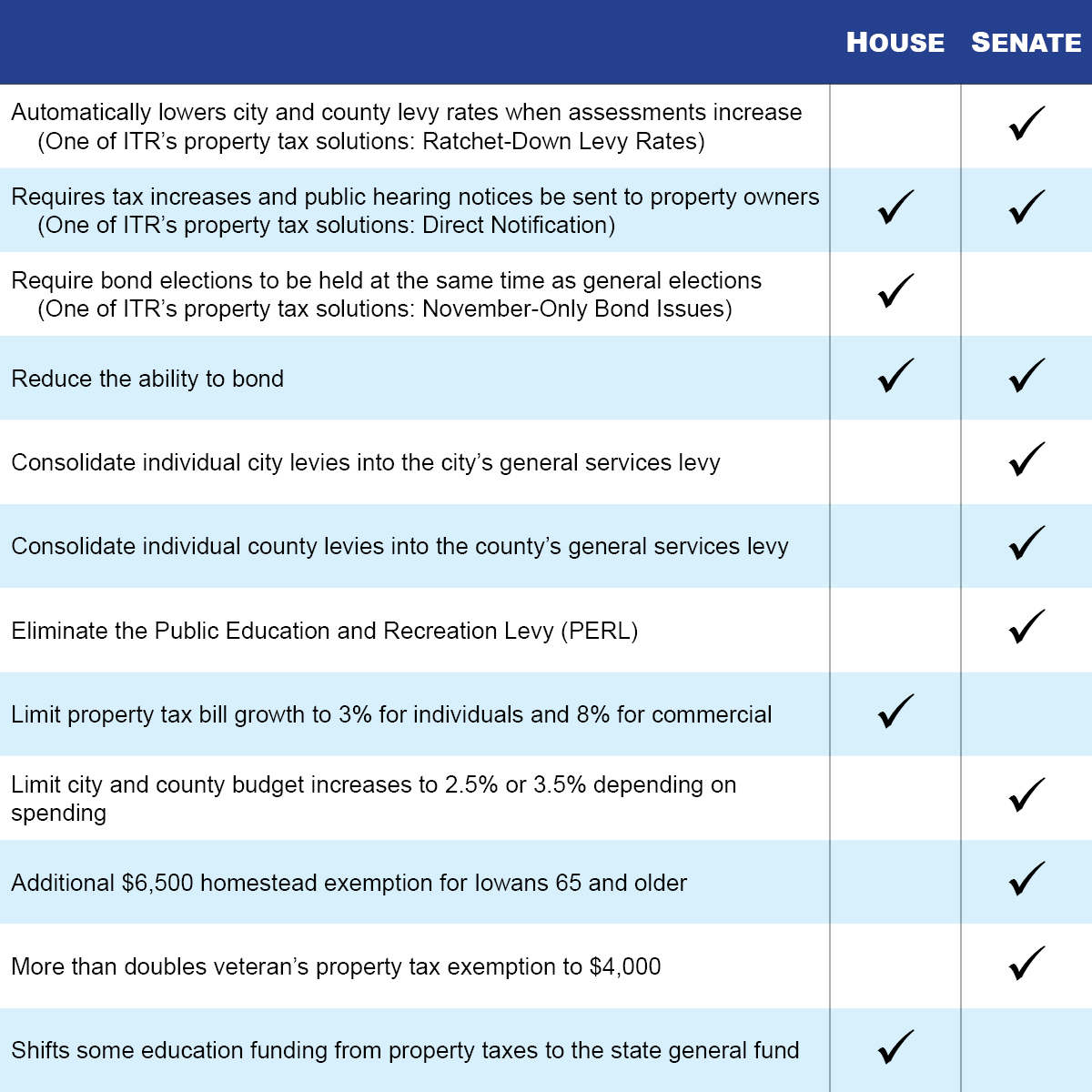

Here is what each chamber’s bill would do:

ITR Analysis

Anytime legislators pass a bill, they want to claim that it’s a significant victory. But will either one of these bills fix the root problem—excessive local government spending?

Effective reform would restrain local government and make the property tax system more transparent. These bills accomplish some of that, but the problem is too big at this point, and neither one is a silver bullet that will solve everything immediately.

ITR has advocated for taking a long-term view of the problem and working to enact reforms that, over time, will bend down the spending curve of local governments and, in turn, help ease Iowans’ tax burden. Some of these proposals are incorporated into these two competing bills.

The Good

- The Senate bill automatically reduces city and county levy rates when assessments increase.

- Both bills require local governments to mail notices of proposed tax bill increases with property-specific information to property owners, as well as the date, time, and location of public hearings on these proposed increases.

- The Senate bill consolidates many smaller levies.

- The House bill requires bond elections to be held at the same time as general elections.

The Bad

The House bill pays for a shift in some education funding from property taxes to the State of Iowa with the Taxpayer Relief Fund (TRF).

This is bad policy for two reasons:

- Money flows into the TRF primarily from the overcollection of income tax. By most accounts, the governor and legislators will continue an income tax reduction conversation next year, so those dollars must be available. The TRF was created over a decade ago and expanded over the years for the purpose of cutting income taxes.

- The way the House bill is written, the TRF will be depleted until it is gone. After draining the TRF, the only thing left will be a hole in the state’s budget, and taxpayers will be on the hook for an ongoing obligation.

Neither one of these bills are a single solution to property taxes in Iowa. Fixing a complex tax system like this will take multiple years and multiple bills just to try and bend the curve down.

ITR lobbyists registered in support of the Senate bill because it can be a launching pad for future property tax reform, and it includes two of our identified solutions:

- Close the honesty gap by “ratcheting-down” levy rates.

- Empower taxpayers with direct notification of tax increases.

ITR registered against the House bill because of the misuse of the TRF. The bill is good politics but bad policy.

We appreciate the legislature considering several of ITR’s ideas, but we also caution lawmakers against a dangerous use of the Taxpayer Relief Fund. Iowans should remain hopeful that an agreement can be reached to take the first step in a long process of crawling out from under a crushing property tax burden.

Learn more about these reform bills by listening to these ITR Live Podcast