Start a conversation.

Ask them why.

When local elected officials choose to spend more and raise property taxes, they need to clearly explain why the government needs the money more than the people they represent.

Is your property tax bill growing faster than your family’s budget? For many Iowans, that is true, and they let us know. Last year, hundreds of ITR members contacted us wanting more information about their property taxes.

To help Iowans understand how their local governments are doing, AND to give the taxpayer a voice, ITR created a searchable online database that compares community growth to the property taxes levied by schools, cities, and counties in response to those requests.

Iowans feel strongly about their property taxes. In fact, we hear more complaints about property taxes than any other tax.

“Just because my house is worth more doesn’t mean I have more dollars to pay taxes.”

“I’m buying less for myself because I have to pay the government more.”

“Property tax increases are making it hard to afford my house. What I’ve worked 50 years to build up, they’re taking away from me.”

Property taxes are complicated and confusing. A significant amount of confusion comes from the fact that your most recent tax bill was determined over a year ago.

By the time you get your bill, it is too late to do anything except feel frustrated, get angry, and complain. However, it doesn't have to be this way.

After selecting your local government (school district, city, or county), itrlocal.org gives you a 10-year history and a simple, one-click form to send a message to the elected officials who determine your property tax bill.

Are your community’s taxes reasonable?

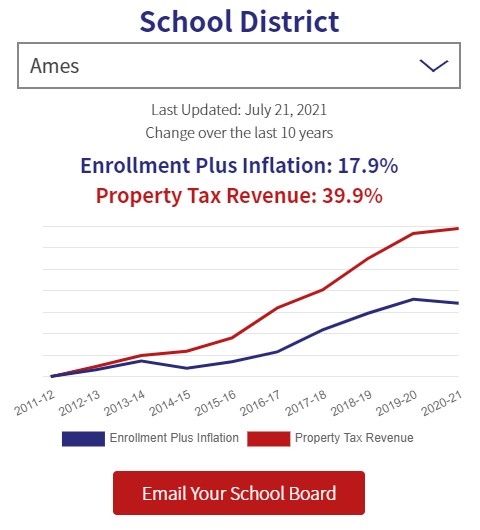

Here is an example of the information provided by itrlocal.org for the Ames School District:

The blue line on the chart is a combination of population growth (or decline) plus inflation. It represents a reasonable growth rate in a local government's budget: when population or enrollment increases, the amount of taxes collected will probably grow as well, because more services have to be provided by local governments. Additionally, inflation increases the cost of providing those services.

The red line is the percent change in total property taxes collected.

Look at the gap between the red and blue lines and percent totals.

A small gap shows the local elected officials are managing their budget within the growth of their community. A large gap shows they have chosen to spend more than what some Iowans consider to be reasonable.

The red button below the line charts will let you easily email your local elected officials.

It is important that a conversation takes place between you, the taxpayer, and your local elected officials. You may agree with their decisions and think your community is moving in the right direction. Or you may disagree completely. Either way, they need to hear from you.

What causes property taxes to increase?

Here are the top three reasons:

-

- Local government spending.

- Local government spending.

- Local government spending.

When local elected officials choose to spend more and raise property taxes, they need to clearly explain why the government needs the money more than the people they represent.

The information provided on itrlocal.org is intended to be used as a way to start an informed conversation with the people who determine how much you pay in property taxes: your local school board, city council, and county supervisors.

In the coming months, we will add additional data to the site, making it even easier for you to understand your tax burden, as well as compare it to other communities across the state. We’ll even be sure to let you know when decisions are being made that will impact your next property tax bill!

It's easy for elected officials to spend more when the taxpayer keeps QUIETLY paying the bill.

So, speak up and make your voice heard!