New Property Assessments

Worried about your property tax bill?

New property assessments will arrive in your mailbox the first week of April. Significant increases in value could push your property tax bill higher.

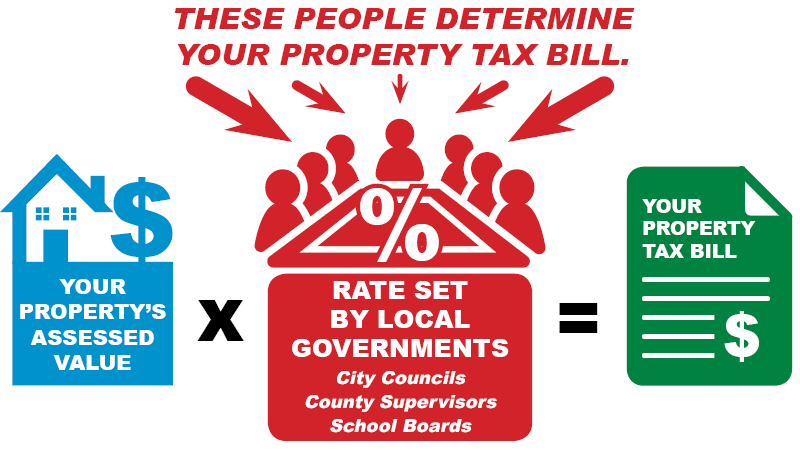

Who sets the amount of your property tax bill?

Much anger is directed at county assessors, but they do NOT determine your bill. In fact, your tax bill can decrease even when your property’s value increases. But that rarely occurs because local government spending always seems to grow.

Assessments are updated every two years, and the values are just one factor in the calculation of property tax bills. The members of your city council, the county board of supervisors, and school boards determine your final bill when they set their budgets.

It’s their spending that creates your tax bill.

Some local governments do a better job than others when it comes to holding the line on spending. Others gladly ride the wave of increased assessments.

Too many local elected officials proudly say property tax rates are staying the same or not increasing as they watch property tax bills grow.

One Des Moines metro city proudly wrote in their newsletter that this will be the “eighth consecutive year they have kept the same levy rate.” It’s truly miraculous that their spending needs are identical to the increase in property values for eight years in a row. This is simply lazy budgeting and disingenuous messaging.

Iowa’s property tax system is broken.

It is time for state lawmakers to enact long-term solutions for controlling the growth of property tax bills:

- Set stronger spending limitations.

- Close the honesty gap by “ratcheting-down” levy rates.

- Empower taxpayers with direct notification of tax increases.

- Tighten TIF and abatement usage.

- Maximize public input with November-only bond issue elections.

Back to your property’s assessment. What can you do?

If you think your property’s assessment is unreasonable, you can file a protest to appeal the value.

Don’t wait! Protests must be filed between April 2 and April 30.

- Learn how to protest your assessment

- Petition to Local Board of Review Form (PDF) Must be filed by April 30

- Find and Contact Your County Assessor