"There will be tens of thousands of people who appeal their assessments and ten people who actually complain to their city council about the spending. It's a wonderful system for big spenders- the assessor takes all of the bullets while local governments can spend away without being bothered."

You knew property valuations were going to increase. This should be good news. Our houses are investments, and we should want them to gain value.

However, this does not mean homeowners have more money to pay their taxes, nor should local governments view this as an opportunity for an automatic tax increase.

This week, Polk County residents found out they can expect about a 22% increase in property valuation when they receive their new assessments next April. Commercial properties can expect about an 18% increase.

It's not just Polk County, huge increases in property assessments will soon be seen across Iowa.

"There will be tens of thousands of people who appeal their assessments and ten people who actually complain to their city council about the spending," said ITR Foundation President Chris Ingstad. "It's a wonderful system for big spenders- the assessor takes all of the bullets while local governments can spend away without being bothered."

Why Are Property Taxes Increasing So Fast?

Here are the top three reasons your property tax bill increases:

- Local government spending.

- Local government spending.

- Local government spending.

The bottom line is local elected officials in too many communities across Iowa are setting budgets that take and spend a larger amount of property tax dollars from households and businesses.

It's not the assessor's fault.

Your local school board, city council, and county supervisors determine how much to spend and, ultimately, the amount of your property tax bill.

Comparing Property Tax Bills Across Iowa

Property taxes create the same reactions in most Iowans: anger and frustration. However, since property tax bills are determined by a handful of local taxing authorities in each community, the size of those bills varies across the state.

Of the 100 largest cities in Iowa, Fort Dodge, Ottumwa, Red Oak, Clinton, and Webster City have the highest property tax bills. Spirit Lake, Eldridge, Carroll, Le Mars, and Evansdale have the lowest.

Click here or on the map below to see statewide information.

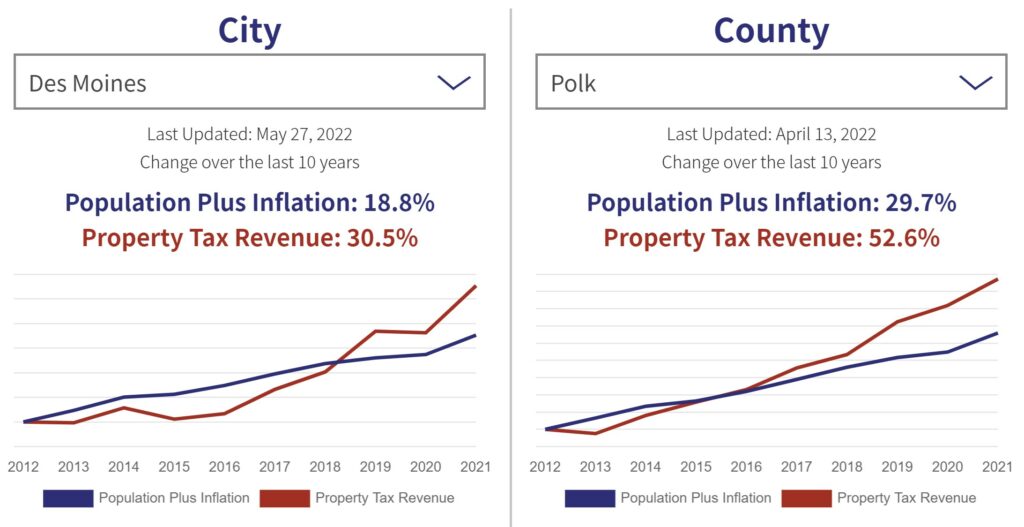

Back to Polk County. Des Moines residents have the 6th highest property tax bills of the 100 largest cities. Why?

The charts below from ITR Local show property tax revenue collected by the city and county has grown faster than the population and inflation.

Some People Are OK With Larger Tax Bills!

A KCCI article quoted two Polk County residents who think increased property tax bills are acceptable as long as it will make Polk County a better place.

One person said, "Like if we were contributing to more of the homeless situation. Like our taxes could actually do something good, then I would be ok paying more, I guess."

Another shared, "There's a lot of sidewalks downtown that the trees aren't trimmed. There are a lot of things that need to be fixed. So, as long as they're going to the right stuff, I'm fine with it."

Every dollar local elected officials spend was first taken from someone who earned it. Existing budgets are large enough to help the homeless and trim trees. Taxpayers must speak up, be louder than the ridiculous spending requests, and demand local officials reduce levy rates to offset assessment increases.

What About Where You Live?

ITR Local has property tax and community growth information for every school district, every county, and 154 cities in Iowa. Email us if you don't see your city listed, and we will add it.

If You Are Upset About Your Property Taxes:

- Visit ITR Local and select your school, city, and county.

- Look at the growth gap between property taxes and enrollment/population.

- Use the built-in email form to quickly start a conversation with the people who determine your property tax bill.