Confronting Government’s Overcollection of Tax Dollars

A bill has been introduced that would change the Taxpayer Relief Fund’s name to the Individual Income Tax Elimination Fund, speed up cuts already in place, and create a path to zero.

All state revenue belongs to the taxpayer, not the government.

So, when Iowans pay more in taxes than the state needs to operate, the money needs to be put back in the hands of taxpayers.

In 2011, the Taxpayer Trust Fund was created to collect excess revenue for the express purpose of providing future tax relief. The fund’s cap was lifted, and the name was changed to the Taxpayer Relief Fund in 2018.

Conservative budgeting has led to multiple billion-dollar surpluses in recent years. This substantial overcollection of tax dollars necessitated a significant reform to the Iowa tax code. That’s why lawmakers passed the largest tax relief legislation in state history last year.

Now, the Taxpayer Relief Fund’s balance is expected to grow to nearly $3 billion by the end of FY 2023 and even more in FY 2024.

This is Your Money

Last week, State Senator Dan Dawson, Chairman of the Senate Ways and Means Committee, introduced a bill, SSB 1126, to change the Taxpayer Relief Fund’s name to the Individual Income Tax Elimination Fund, speed up cuts already in place, and create a path to zero.

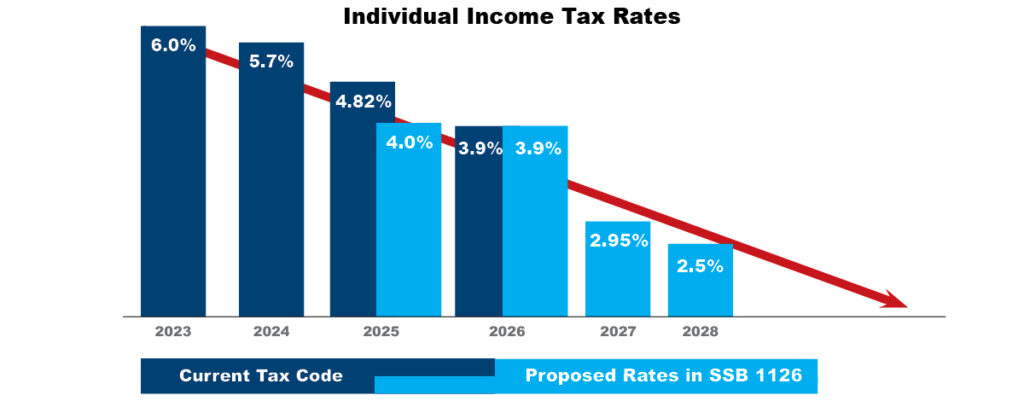

ITR Foundation posted a more detailed analysis of the bill, including a revision to the corporate income rate reduction calculation. Their chart below shows the proposed acceleration and continued reduction of Iowa’s individual income tax rates.

Senator Dawson’s bill deserves serious consideration because it is a responsible way for Iowa to stay competitive with other states and become an even stronger leader in tax reform.

These rate reductions are not a short-term measure to use up the Taxpayer Relief Fund and then let income tax rates increase or leave a deficit in the budget. The bill is a prudent, sustainable way to confront and permanently end the overcollection of tax dollars from Iowans through income tax.

The Temptation to Spend

The longer this fund continues to grow, the more likely it is that legislators see a large pot of money and will want to spend it or use it for some other purpose than tax relief at the state level.

ITR President Chris Hagenow, who was a legislator when the fund was created, said on the ITR Live podcast:

“I was there when it was the Taxpayer Trust Fund. The whole idea was when the state brought in more money than it needed, those dollars would be taken off the table, out of the hand of the spenders, and create a mechanism to ultimately give it back to the taxpayer.”

SSB 1126 Status (as of 2/11/2023)

2/2/23 – Assigned to Senate Ways and Means Subcommittee