Four percent flat tax analysis: Iowans all across the income spectrum will save significant money, and that savings will be delivered without simply redistributing wealth.

“The amount of money they withheld for taxes made me sad.” On her first payday for a full-time job, a recent college graduate and newly hired employee looked at her paystub and made that remark. Yes, it’s sad and sometimes even infuriating that governments take so much money from taxpayers.

However, Governor Kim Reynolds, House Republicans, and Senate Republicans want to ease our income tax pain this year. All three have plans that significantly lower the state’s individual income tax rates. Just how much that burden will be eased has been the subject of some debate.

When the governor released her proposal, which was headlined by a flat 4.0% rate for individuals, some economists and even editorial boards claimed this reform plan wouldn’t actually cut taxes for Iowans on the lower end of the income scale. Or if the tax bill would go down for those same Iowans, the savings wouldn’t really amount to much. The problem with those claims is that they aren’t true, and they were likely made without actually digging into the details of how the proposed tax code would work.

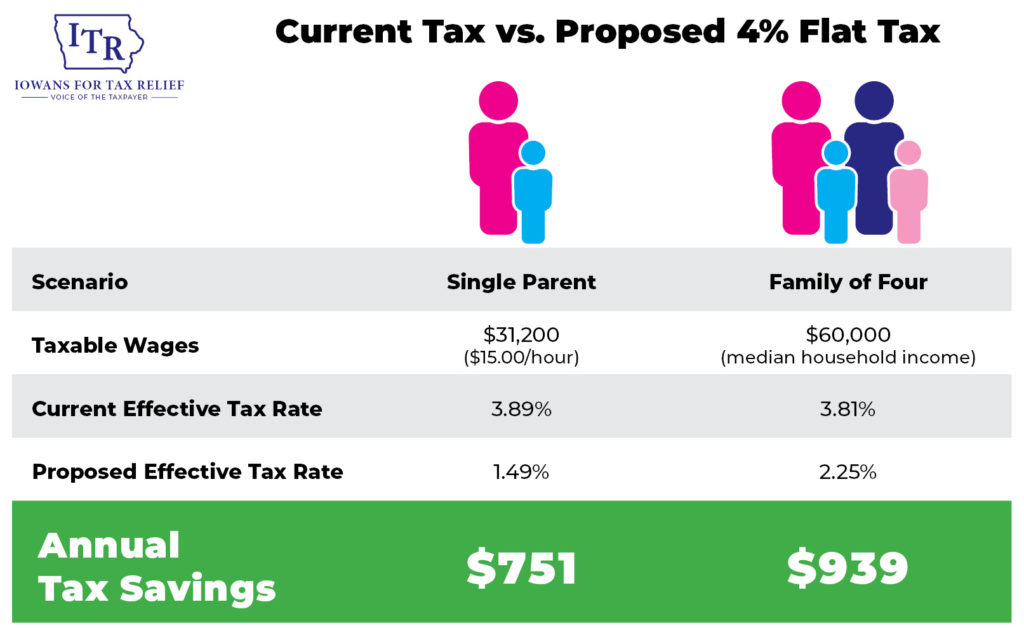

Instead of arriving at a quick but inaccurate conclusion, Iowans for Tax Relief took the governor’s 4.0% flat tax proposal to an Iowa CPA firm. We asked the professional tax preparers there to analyze multiple scenarios that compared 2022’s current tax code with what the governor had proposed. The analysis is now complete, and here’s the reality: Iowans all across the income spectrum will save significant money, and that savings will be delivered without simply redistributing wealth.

For instance, a single parent working full-time for $15 per hour ($31,200 annually) would save $751 a year. That dollar amount is meaningful, considering the median amount paid for the rent of a two-bedroom apartment in Iowa is around $760.

Moving up the income scale, a family of four earning $60,000 (the median Iowa household income) will save $939 annually. Again, this is an amount that will make a meaningful difference in the family budget.

Even with a flat tax, individuals with higher incomes still pay a higher effective tax rate due to items like the standard deduction, though that rate is obviously capped at 4.0%. Iowans at higher income levels would still be paying their fair share. Consider the effective tax rates Iowans would be subject to under the governor’s plan:

• Single parent earning $31,200 – 1.49%

• Family of four earning $60,000 – 2.25%

• Family of four earning $250,000 – 3.58%

• Family of four earning $450,000 – 3.77%

While Iowa House Republicans are moving legislation forward with the same 4.0% rate as the governor, Iowa Senate Republicans have proposed an even lower tax rate of 3.6 % and are advancing those reforms through their chamber. Under the Senate plan, savings across the board could be even greater than what our accountants calculated for this analysis. You can check out ITR’s tax plan comparison for details about each tax reform plan.

Tax calculations are tricky and complicated, and no two households are alike. Other analyses and estimates might show different savings amounts, but the bottom line is this: ALL Iowans will pay less state income tax and keep more of the money they earn under the proposals that are moving through the Iowa Capitol.

Current estimates show Iowa will collect nearly $1 billion more in taxes for the current fiscal year than what lawmakers are planning to spend. Furthermore, over $2 billion will soon be in the Taxpayer Relief Fund, a special account that collects overpaid tax dollars. President Ronald Reagan said, “Government always finds a need for whatever money it gets.” So, Iowa needs to stop the overcollection of money from Iowa taxpayers.

Structural changes to Iowa’s tax code like the ones being considered by our lawmakers will improve Iowa immediately and for generations to come. None of the plans would decrease the amount of money that is currently collected in the state’s General Fund, so there will still be sufficient money to fund state government’s priorities. We just hope payday can get a little brighter for everyone.