New Info For Attacking The Growing Property Tax Burden

ITR Local: Your Property Tax Information Website

The property tax burden in Iowa has been a growing concern. Frustration and discontent have steadily risen as local government spending continues to drive up the cost of property ownership.

At a time when the current economic environment is forcing families to stretch their budget for essential items like food and gasoline, something has to be done about unreasonable property taxes.

The ITR Local website can help identify your community’s problem.

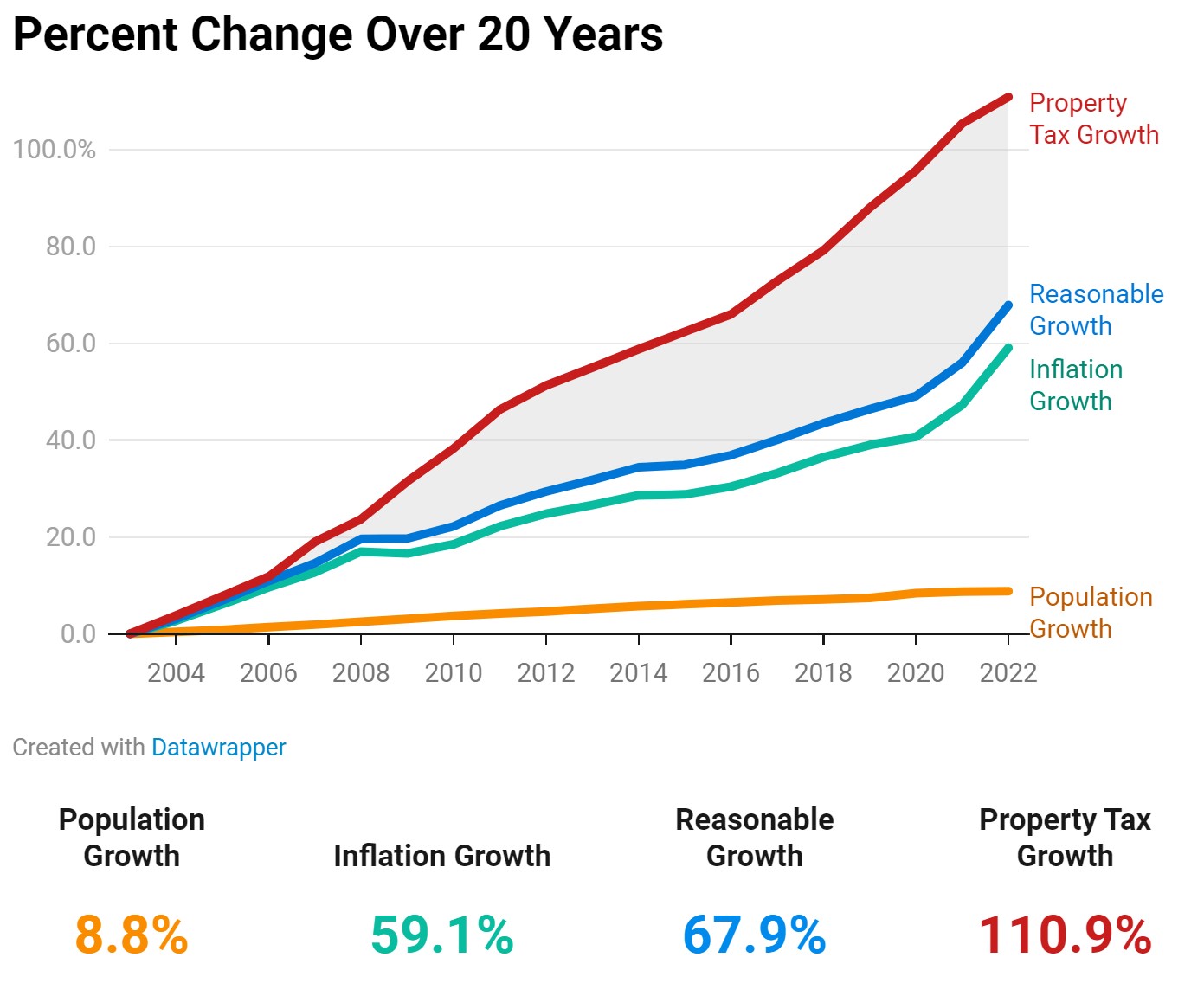

The chart below shows the total property taxes collected by local governments across Iowa have grown much faster than the state’s population and inflation.

What is reasonable? A reasonable property tax growth rate is one that is close to the combined percent change of inflation and population.

Your Property Taxes

When a city council, county board of supervisors, or school board chooses to increase spending and raise property taxes, they must clearly explain why the government needs more money than the people they represent.

The new and improved ITR Local website is designed to provide crucial insights into your local government’s financial decisions. The user-friendly site offers comprehensive data and information about property taxes, budgets, and spending in your city, county, and school district.

Take a look, print the charts and tables, share with neighbors, and most importantly, start a conversation with your local elected officials and candidates for those offices.

Be sure to look at all the information. Even if the growth rate is reasonable, spending and levy rates might be higher than taxing authorities of similar size.

You know your community. If one of the data points seems unusual, ask the elected officials for an explanation.

Together, we can work towards addressing the challenges of local government spending and the issue of high property taxes in Iowa.